Retirement

Plan Philosophy

TCG manages and develops portfolios for hundreds of clients with the goal of delivering solid and consistent risk-adjusted performance.

Today, TCG serves over 750,000 individuals across hundreds of plans in the governmental sector and small-to-medium business segments.

We strive to employ well-defined and repeatable investment processes. We utilize the five pillars below to ensure each one of our clients receives the best experience.

5

Pillars of Successful

Retirement Plans

5 Pillars of Successful Retirement Plans

1

Plan Design

Studies show that plan design can have the single largest impact on participant outcomes. Along with industry trend updates, we provide peer and industry comparisons, which helps ensure your plan is competitive for retaining and recruiting top talent.

2

Fiduciary Service

As a registered Investment Advisor, TCG is held to a fiduciary responsibility to act in our client’s best interest. Unlike advisors who receive compensation from brokers and earn commission, our fees are simple and fully transparent

3

Investment Consulting

We work with you to develop and properly maintain your Investment Policy Statement. A formal, objective, and consistent process is the best way to protect the organization and benefit your valued employees.

4

Participant Advice

Positive participant outcomes are based on well-educated participants and that is why we devote extensive resources to provide plan education. Technology tools cannot be a complete substitute for personal interactions but can assist in leveraging conversations when employees need them most. TCG has developed the TeleWealth platform for just these relationships.

5

Plan Oversight

Administering a plan is not easy for plan sponsors and managing providers can be burdensome. The best advisors provide support to simplify searching for providers, as well as the ongoing management, benchmarking, and review of current providers.

About Us

We help you get ready for tomorrow

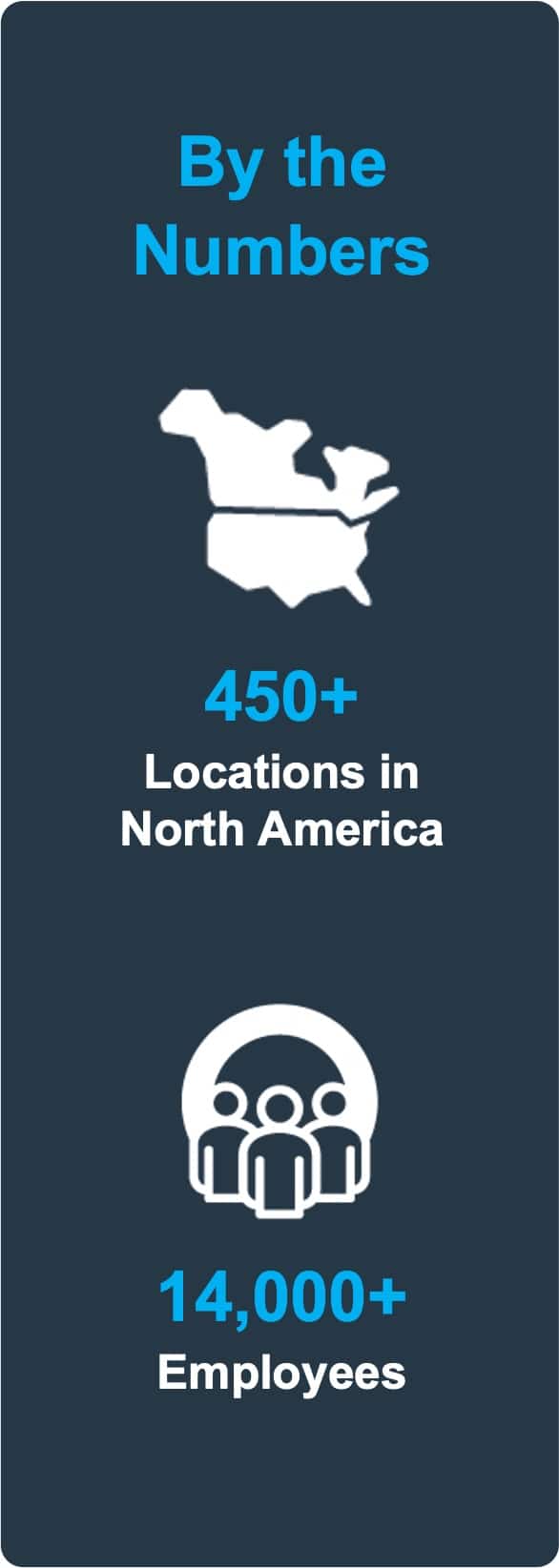

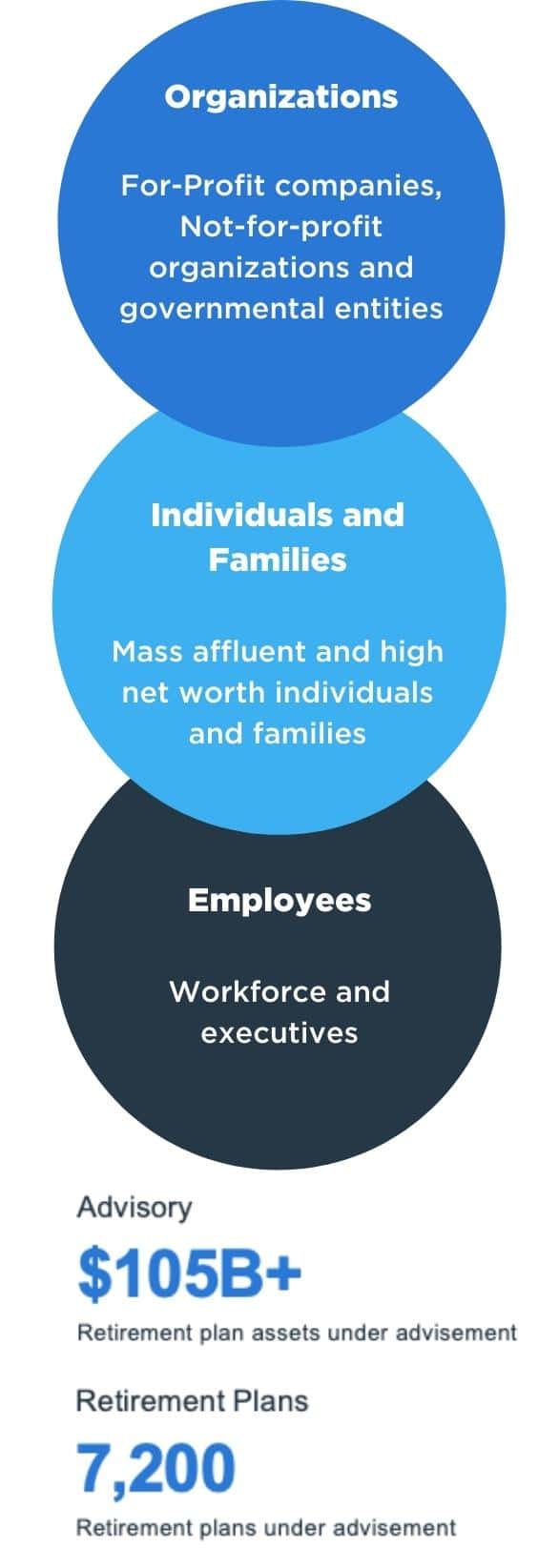

When you partner with TCG, a HUB International Company you’re at the center of a vast network of retirement, wealth management, and financial wellness specialists ready to bring clarity to a changing world with tailored solutions and unrelenting advocacy.

Who We Serve

Send Your Questions

TCG, a HUB international company

+1 (512) 600-5200

900 S Capital of Texas Hwy Suite 350 Austin, TX

Please fill out the form below

DISCLOSURES

TCG Advisory Services, LLC (“TCG Advisors”) is a registered investment advisor regulated by the U.S. Securities and Exchange Commission (SEC) subject to the Rules and Regulations of the Investment Advisor Act of 1940, and is a part of TCG Group Holdings, LLP. Registration with the U.S. Securities and Exchange Commission does not imply a certain level of skill or training. We are located in Austin, Texas. A copy of our Form ADV Part 2 is available upon request.

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.

Past performance may not be indicative of any future results. No current or prospective client should assume that the future performance of any investment or investment strategy referenced directly or indirectly in this brochure will perform in the same manner in the future. Different types of investments and investment strategies involve varying degrees of risk—all investing involves risk—and may experience positive or negative growth. Nothing in this brochure should be construed as guaranteeing any investment performance.

This website may contain forward-looking statements and projections that are based on our current beliefs and assumptions on information currently available that we believe to be reasonable; however, such statements necessarily involve risks, uncertainties, and assumptions, and prospective investors may not put undue reliance on any of these statements.

Salary Finance branded loans are offered by Axos Bank® Member FDIC, and are subject to eligibility, underwriting, terms and conditions, and approval. Employees who primarily work in DC, IL, IN, NH, NJ, NY and WV are not able to make repayments via salary deduction due to state legislation, and instead will be asked to choose an alternative repayment method.