The Teacher Retirement System of Texas (TRS) was given authority by the Texas Legislature in 2001 to oversee 403(b) companies and products. In our view, they have done an excellent job of fulfilling their responsibilities over the past 16 years while managing to follow complex laws involving hundreds of companies, thousands of products, many third-party administrators and tens of thousands of school district employees.

TRS recently published new proposed 403(b) rules. This summary is intended to provide a high-level description of the new rules and background for the changes. For our school district clients, we do not expect these changes to result in a noticeable difference in your 403(b) plans.

In March 2016 TRS staff began a review of current 403(b) rules. This was due partly to statutory requirements and partly because the staff felt that TRS has a duty to provide the best possible product rules for the benefit of Texas educators.

Why is this important? This quote from the TRS staff presentation to the TRS Board in September 2017 provides excellent background (TCG emphasis added):

“Retirement Security:

- Per a 2012 TRS study, the defined benefit plan replaces roughly 68% of a career employee’s pre-retirement income at initial retirement and provides a lifetime benefit that equates to 52% of pre-retirement income.

- Members will likely need to supplement their TRS pension with personal savings.

- Low fees protect employees against erosion of returns on their investment dollars.”

The primary supplemental retirement savings vehicle used by the vast majority of TRS members is the 403(b) plan. Currently they can choose from 84 companies offering 11,685 products/investment options.

TRS interviewed a number of companies about the rule, including TCG Administrators and held public hearings seeking input. In June 2017 the staff published proposed revised 403(b) rules. Industry reaction was swift and, for the most part, negative.

The primary objection to the new rules was lowering fees and surrender charges. The main argument against the rules was that the proposed fees and surrender charges would not support a sales force capable of adequately serving the employees who buy 403(b) products. Participation in 403(b) plans in Texas schools is poor. In most districts it is below 20% of employees and in some rural districts it is near zero. The industry argued that the only reason that participation is as at current levels, even if low, is due to the efforts of 403(b) sales people, advisors and practitioners.

The TRS staff and their consultant, AON Hewitt, did a large amount of research on fees in the retirement industry. They found that the fees for 403(b) products in Texas were high by a number of standards. A number of Texas 403(b) industry commentators disagreed and provided statistics, particularly in the 403(b) industry, that showed different results.

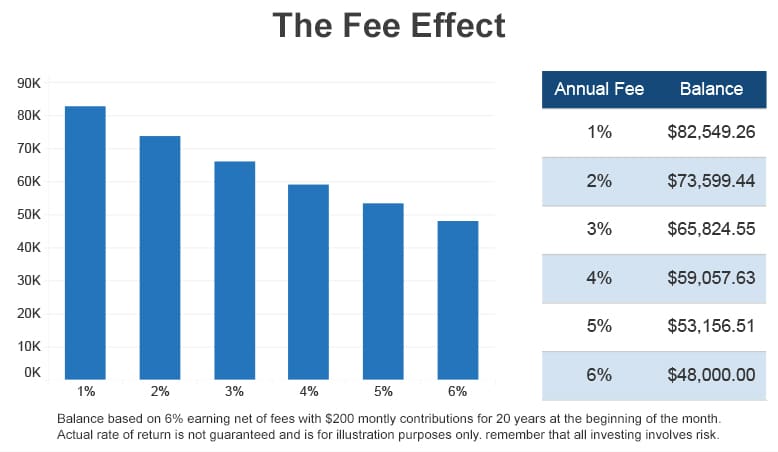

It is important to understand that the higher the fees, the less money an educator has at retirement. This is irrefutable, regardless of industry statistics. TRS does an excellent job of providing product fee information on their 403(b) website in an easy-to-use format that would help educators make better decisions about their choice of investments if they would use this website. TRS plans to continue to provide this information in the future. Below is an example of the effect of fees on retirement savings outcomes used by TCG in our retirement seminars (note that this is a generic example and that a 5% or 6% fee would not normally be allowed under TRS rules).

Although TCG supports keeping fees as low as possible, we have to agree with the industry that significantly lowering current fees and surrender charges is likely to ultimately reduce 403(b) plan participation. This is a difficult trade-off.

A second objection by most industry commentators was that the new rules would be effective sooner than companies and other regulators (e.g., Securities and Exchange Commission, Texas Department of Insurance) could implement the changes.

TRS staff revised the proposed rules and presented these to the TRS Board in September 2017. The re-proposed rules were published for public comment in the Texas Register at:

https://www.sos.state.tx.us/texreg/archive/June162017/Proposed%20Rules/34.PUBLIC%20FINANCE.html

This would revise the Texas Administrative Code. The cite is “Title 34. Public Finance, Part 3. Teacher Retirement System of Texas, Chapter 53. Certification by Companies Offering Qualified Investment Products, 34 Tac §§53.1, 53.3 – 53.17.”

The key parts of the revised rules are:

- Lower fees. This would include:

- Cap annual asset based fees per the chart below. *

- Eliminate front-end and back-end sales charges and surrender charges for variable annuities, custodial accounts and mutual funds.

- Cap fixed dollar administrative fees at $60 per year.

- Lower the maximum amount of certain transaction fees such as loan processing fees.

- Officially cap 403(b) surrender charges for fixed interest annuities at 10% with a maximum surrender charge period of 10 years (note that most products already comply with this rule).

- Broaden and change the classification of types of 403(b) companies.

- Significantly increase the fees for registering 403(b) companies and products with TRS.

- Update the Texas Administrative Code to reflect legislation passed in recent sessions of the Legislature.

*Chart of maximum annual asset fees:

| Asset Classes | Maximum Annual Product Administration Fee | Maximum Annual Expense Ratio | Maximum Annual Asset-Based Fee |

| Money Market | 1.25% | 0.15% | 1.40% |

| Diversified Bond | 1.25% | 0.50% | 1.75% |

| Balanced | 1.25% | 0.50% | 1.75% |

| Large Cap U.S. Equity | 1.25% | 0.50% | 1.75% |

| Small/Mid Cap U.S. Equity | 1.25% | 0.70% | 1.95% |

| International Equity | 1.25% | 0.80% | 2.05% |

| Global Equity | 1.25% | 0.80% | 2.05% |

The new rules would apply to all products registered on or after October 1, 2018. However, all current 403(b) products under a salary deferral agreement as of November 16, 2018 would be “grandfathered.”

TCG provided two comments that were not acted upon by TRS but that we feel strongly should be implemented in the future. These are:

- Illegal “Pay to Play” Arrangements. Current 403(b) rules established by the Texas Legislature and TRS are designed to provide a fair and open structure that allows participants to choose the companies and investment products they want, as long as these meet TRS rules. There are third party administrators and school districts that unfairly restrict participant choices. They include “pay to play” arrangements whereby 403(b) companies that do not pay a fee to the third-party administrator are not allowed to offer their products. We believe that this is illegal under Texas law. We urge school districts allowing this arrangement to eliminate this practice.

- Abusive Vendors and Advisors. There are 403(b) companies and individual sales people, advisors and practitioners who use abusive sales tactics. In particular, they often send “spam” emails to all employees in a school district with misleading or incorrect information to aid their sale of products. School districts repeatedly complain about this. Districts need to have the right to eliminate such companies and advisors.

We expect the re-proposed TRS rules to be accepted by the industry. The one area where there will probably be a number of negative comments to TRS is the timeline for implementation. TRS staff had discussed delaying the implementation of the new rules to 2019. TCG believes this would be fairer to companies considering the time it often takes to develop new products and get them approved by applicable regulators.

Thus, as stated earlier, for our school district clients we do not expect these changes to result in a noticeable difference in your 403(b) plans.

If you have any questions please feel free to contact Scott Hauptmann, COO of TCG Administrators at shauptmann@tcgservices.com or Mike Cochran, Partner, TCG Administrators at mcochran@tcgservice.com.