Plan Education

Retirement Plan Comparison

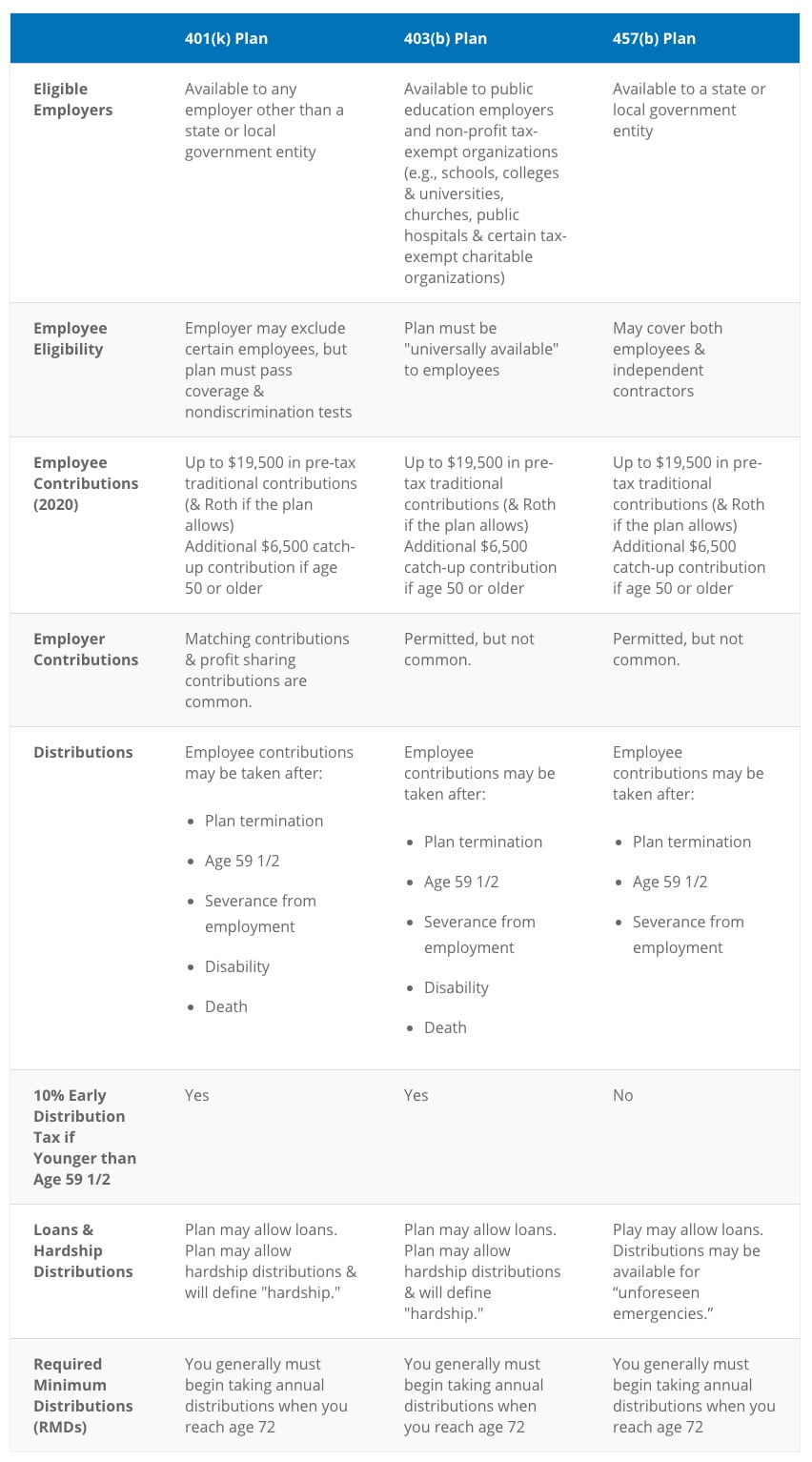

| 401(k) Plan | 403(b) Plan | 457(b) Plan | |

|---|---|---|---|

| Eligible Employers | Available to any employer other than a state or local government entity | Available to public education employers and non-profit tax-exempt organizations (e.g., schools, colleges & universities, churches, public hospitals & certain tax-exempt charitable organizations) | Available to a state or local government entity |

| Employee Eligibility | Employer may exclude certain employees, but plan must pass coverage & nondiscrimination tests | Plan must be "universally available" to employees | May cover both employees & independent contractors |

| Employee Contributions (2024) | Up to $23,000 in pre-tax traditional contributions (& Roth if the plan allows) Additional $7,500 catch-up contribution if age 50 or older | Up to $23,000 in pre-tax traditional contributions (& Roth if the plan allows) Additional $7,500 catch-up contribution if age 50 or older | Up to $23,000 in pre-tax traditional contributions (& Roth if the plan allows) Additional $7,500 catch-up contribution if age 50 or older |

| Employer Contributions | Matching contributions & profit sharing contributions are common. Click here to view your plan. | Permitted, but not common. Click here to view your plan. | Permitted, but not common. Click here to view your plan. |

| Distributions | Employee contributions may be taken after:

| Employee contributions may be taken after:

| Employee contributions may be taken after:

|

| 10% Early Distribution Tax if Younger than Age 59 1/2 | Yes | Yes | No |

| Loans & Hardship Distributions | Plan may allow loans. Plan may allow hardship distributions & will define "hardship." | Plan may allow loans. Plan may allow hardship distributions & will define "hardship." | Play may allow loans. Distributions may be available for “unforeseen emergencies.” |

| Required Minimum Distributions (RMDs) | You generally must begin taking annual distributions when you reach age 72 | You generally must begin taking annual distributions when you reach age 72 | You generally must begin taking annual distributions when you reach age 72 |

Have questions?

Our team of Retirement Plan Specialist is standing by to help you open a new plan. Click below to schedule your call:

Need help with your plan?

If you’re an active plan participant and have questions about your plan, please reach out to our customer service team.