PUBLIC EMPLOYEES

Financial Solutions for Government & Non-Profit Employers

Learn more about our financial solutions for government and non-profit employees.

Retirement Plan Philosophy

TCG Advisors manages and develops portfolios for hundreds of clients with the goal of delivering solid and consistent risk-adjusted performance.

Five Pillars of Successful Retirement Plans

1. Plan Design

2. Fiduciary Service

best interest.

3. Investment Consulting

4. Participant Advice

extensive resources to provide plan education.

5. Plan Oversight

Retirement Plan Services

Plan Administration & Compliance

Dedicated Account Service

Employee Education

Plan Documents

Online Systems

Customer Service

Loan & Distribution Management

Participant Communication

Roth Deferrals

Why Choose Us

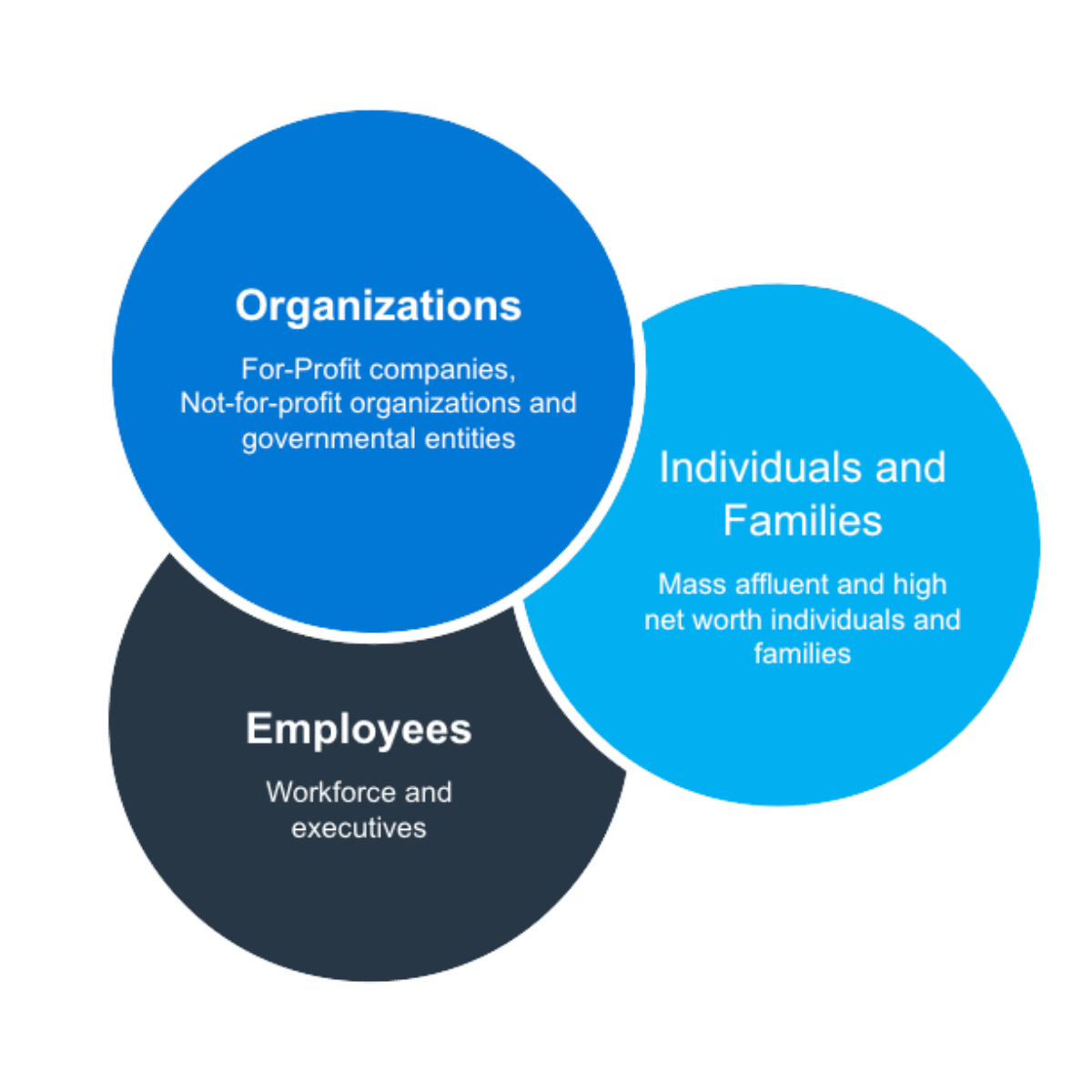

We advise businesses and individuals on how to reach their goals. When you partner with us, you’re at the center of a vast network of risk, insurance, employee benefits, retirement and wealth management specialists that bring clarity to a changing world with tailored solutions and unrelenting advocacy.

We help you get ready for tomorrow.

Focused on Employee Financial Outcomes

Our team of advisors, customer service representatives, and account managers will be there every step of the way.

One-on-One Appointments

We'll set up individual appointments in person or via web conferencing.

Communication

Year-round communication on the latest retirement plan updates.

Workshops

Quarterly seminars help employees stay in-the-know.

Calculators

We provide self-service tools to help assess personal situations.