If we’re smart, we usually drop the weight shortly after the holidays. It’s not so different from the stock market: volatile, fluctuating, and correcting.

So along with fall, volatility has reared its head and is back again. Every year since 1996, the stock market never fails to have seasons of fluctuation. Volatility is like that new obligatory Halloween movie that comes out every year: scary by itself, then made to seem even scarier by all the media surrounding it. Take a look at this most recent market fluctuation: it dropped less than 10% after hitting new highs for the year, yet every article was describing it as the next market crash. It’s totally normal for the market to have corrections, and it’s just as normal to have Bear markets (where prices fall, so people get spooked and start to sell). The great thing about a Bear market or a correction is they recover 100% of the time.

Everyone wants to perform like the stock market until it goes down. It’s not so different from how everyone wants to eat sweets during the holiday season but doesn’t want to gain the weight that inevitably follows. We want all the returns with no risk; all the calories with no consequences. The goal is to take the fear of volatility and lessen the impact it has to your portfolio. It’s simpler than you think; just remember these tips:

- Meal Planning. Focus on your objectives and financial plan.

- Try a salad sometimes. Diversify your investments.

- Don’t live in your elastic pants. Manage risk that you can control.

- Get off the scale. Review investments periodically.

Meal Planning. Your investments should always begin with a plan. Start by asking yourself these questions: Do you know the amount of money you can spend each year? What are the average annual returns you can expect? What is or what will be the total amount of money you have for retirement? Create a financial plan for your goals, then invest to accomplish these goals. The plan will determine what rate of return you need to achieve your goals, and TCG Advisors can be here to help you along the way.

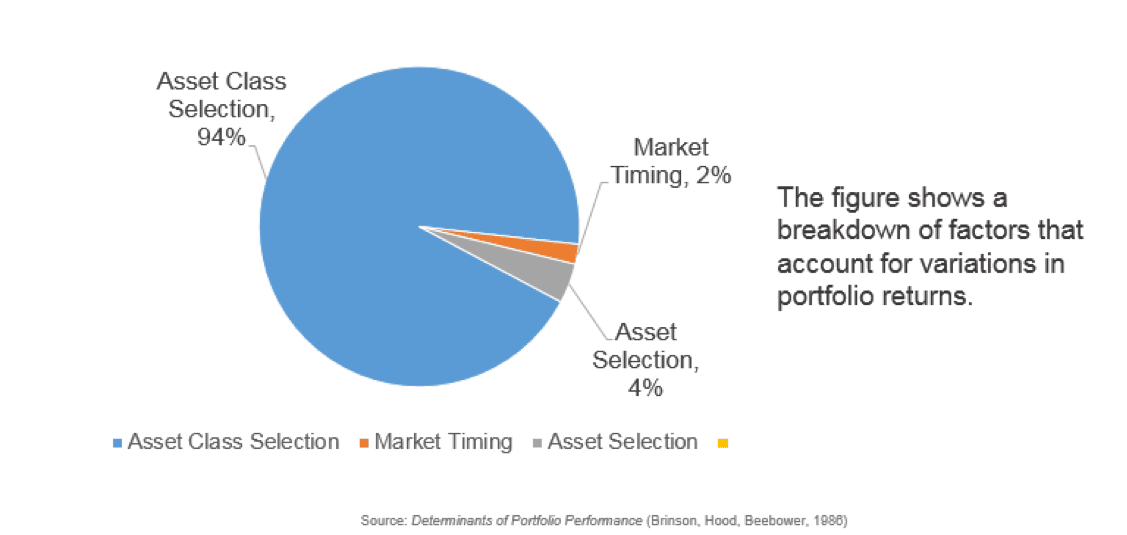

Try a salad sometimes. The purpose of diversification is to invest in multiple asset classes at the same time. Asset classes can perform well and poorly at different times. Add a rebalancing approach to the strategy, and the portfolio will rebalance to take profits from well-performing asset classes and invest in asset classes that are trading at a discount. If you invest in such a way that large swings in the market don’t impact you, you can take volatile days off while the rest of investors panic. If you can’t stomach a 3% swing in the market on a one-day period, you need to make some changes to your investment strategy.

Don’t live in your elastic pants. As an investor, you can only lose as much as the risk you take. It’s just like sticking to a 2,000 calorie per day diet even during the fall months. If you manage risk against your goals, the volatility in your portfolio should be the minimal amount necessary to achieve those goals. If you’re retired and your goal is income generation, volatility might be less of a concern as you’re receiving your distributions. If you have a long-time horizon, a Bear market can be your friend if you are contributing funds and investing at a discount along the way.

Risk management is often the missing piece to most asset allocation portfolios. A simple buy-and-hold approach isn’t enough to tackle your investments; that’s why TCG diligently monitors portfolios and allocations, and you should too.

Get off the scale. The more you look at your investments, the more likely you are to overreact. For example, if you watch them every day, you’re tempting yourself to gamble rather than invest. You’ll start to think you have an edge over everyone else. Market timing does not work over the long run, so step off the scale and stop checking your weight so often. Don’t jump around to new fad diets to lose a few pounds here and there; just stick to a healthy lifestyle and invest according to your plan.

The markets will continue to move up and down. Create a financial plan, set your goals, select diversified investments, and don’t watch them every day. If you follow these steps, volatility will become a conversation starter at your holiday party rather than your worst fear. In anticipation of the volatility season, TCG has made some portfolio changes to manage risk inside client portfolios. We knew overeating would occur at some point, so we went to the gym and worked out ahead of time.