How to seek the best tax benefits with your retirement plan

Lower your taxes now

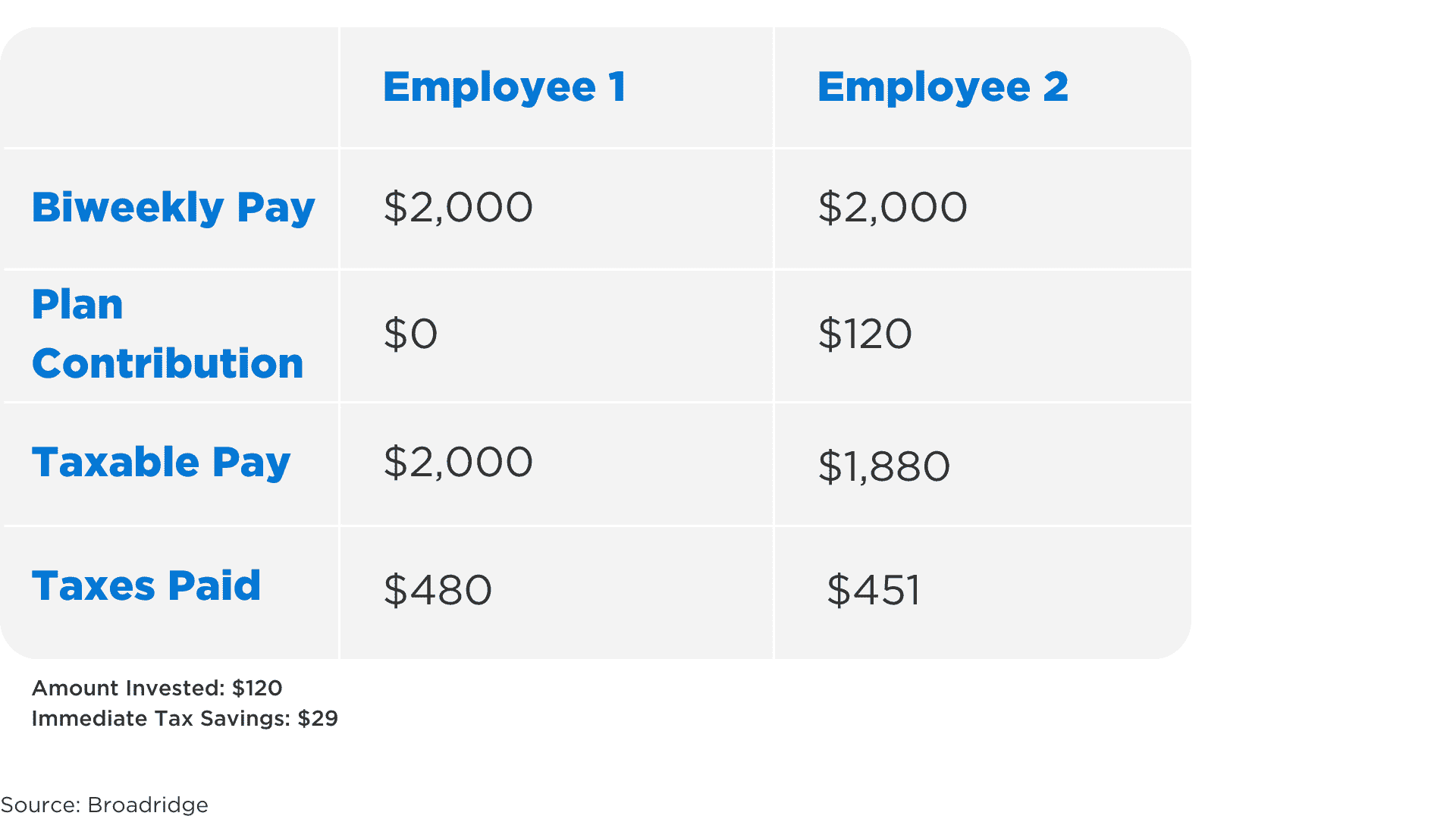

Contributions to a standard retirement savings plan, like a 401(k), 457(b), or 403(b), are withdrawn from your pay before income taxes are applied. Each year, these “pretax contributions” lower your current taxable income, which in turn lowers the amount of income tax you pay to Uncle Sam. Take a look at the sample below, which contrasts two different employees.

Example: Let’s assume Employee 1 gets paid every two weeks, with gross pay of $2,000 and a 24% federal tax rate. In this case, Employee 1 would pay about $480 in taxes each pay period. Now let’s assume Employee 2, who earns the same gross pay and has the same tax rate, contributes 6% of his salary each year to a retirement savings plan. In this instance, his gross pay would be reduced by $120 each pay period, resulting in a taxable income of $1,880. In this case, taxes would be about $451 — or $29 less than the previous scenario. So Employee 2 would have invested $120 in a retirement savings plan and saved $29 in current income taxes.

Keep in mind that this example is hypothetical and has been simplified for illustrative purposes only. Your personal situation will differ. Withdrawals would be taxed at then-current rates. Early withdrawals prior to age 59½ will be subject to a 10% penalty tax, unless an exception applies.

Tax-deferred growth opportunities

Tax deferral is the process of delaying (but not necessarily eliminating) the payment of income taxes on returns you earn. Whereas in taxable investment accounts, you would have to pay taxes on your earnings — even if you reinvest them — in a tax-deferred account, you can delay paying taxes on your returns until you withdraw money. For example, the money you put into your employer-sponsored retirement account isn’t taxed until you withdraw it, which might be 30 or 40 years down the road!

Tax deferral can be beneficial because:

- The money you would have spent on taxes remains invested

- You may be in a lower tax bracket when you make withdrawals from your accounts (for example, when you’re retired)

- You can potentially accumulate more dollars in your accounts due to compounding

Compounding is the process where your earnings become part of your investments, and can potentially earn returns. The advantage of compounding may not be as large in the early years, but as time passes, your total return may see a significant increase.

Remember that returns are not guaranteed. Your investments will fluctuate through the years. Also, withdrawals prior to age 59½ will be subject to a 10% penalty tax in addition to regular income taxes unless an exception applies.

Tax-free income in retirement

Tax deferred is not the same as tax free. “Tax free” is when no income taxes are due at all. Some employer-sponsored savings plans, like Roth 401(k)s, Roth 403(b)s, and Roth 457s, can generate tax-free income during retirement. When you contribute to a Roth account, you don’t receive a current tax benefit like you would with a traditional pretax savings account, but your earnings can still grow without having to pay taxes on them each year. Then, qualified withdrawals are tax free. (Non-qualified withdrawals are subject to regular income and penalty taxes.) In general, a withdrawal from a Roth account is qualified if it satisfies both of the following requirements:

- It’s made after the end of a five-year waiting period

- The payment is made after you turn 59½, become disabled, or die

Taxes make a big difference

Let’s assume two people have $5,000 to invest every year for a period of 30 years. One person invests in a tax-free account like a Roth 401(k) that earns 6% per year, and the other person invests in a taxable account (an investment account outside his or her retirement plan) that also earns 6% each year. Assuming a tax rate of 24%, in 30 years the tax-free account will be worth $395,291, while the taxable account will be worth $308,155. That’s a difference of $87,136.

This hypothetical example is for illustrative purposes only, and its results are not representative of any specific investment or mix of investments.

How much can I contribute?

In 2022, individuals can contribute up to $20,500 to a 401(k), 403(b), or 457 plan. The limit increases to $27,000 for those age 50 or older.

If your plan offers a Roth option, you can split your contributions between the traditional and Roth plans, but the total amount cannot exceed these limits. Be sure to check your plan’s documents as some plans may impose lower limits.

Even if you cannot contribute the maximum amount, be sure to contribute what you can. With the power of compounding, even small amounts have the potential to add up over time. Then, try to increase your contribution when possible — for example, as you receive raises or pay off debts.

Employer Contributions

Your employer may also contribute to your plan account through matching or profit-sharing contributions. These contributions also benefit from tax deferral. In other words, you do not have to pay taxes on employer contributions or their earnings until you withdraw them. If your employer offers a matching contribution, try to contribute enough to receive the full amount. Employer matches are free money so try to take full advantage of them!

Bottom Line

While tax considerations shouldn’t be your only concern when investing for retirement, it’s a plus to know that participating in your employer-sponsored plan can help you keep more money in your own pocket and put less in Uncle Sam’s.

DISCLOSURES

Investment advisory services offered through TCG Advisors, an SEC registered investment advisor. Insurance Services offered through HUB International. Although the information in this blog has been compiled from data considered to be reliable, the information is unaudited and is not independently verified.

Tax services offered through RPW Solutions. TCG Advisors does not provide tax, legal or accounting advice. This presentation was prepared for information purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisor before engaging in any transaction.

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. TCG.53.2022