October Recap and November Outlook

Economic data showed some movements in the right directions, both up and down. The Federal Reserve responded by talking about letting the economy catch up to the rate increases already enacted. Does that mean that the path forward will be smoother and potentially skirt a recession?

Let’s get into the data:

- The October non-farm payroll number was 261,000. The report from the Department of Labor marked the slowest increase since December of 2020. This was a slight decrease from the September number, released in early October, of 263,300.

- The unemployment rate increased to 3.7%. The unemployment figure that includes discouraged workers and those holding part-time jobs increased to 6.8%.

- 12-month CPI was 8.2% September. The Bureau of Economic Statistics reported a slight decrease in the annual figure, from 8.3% in August.

- Third quarter GDP came in at 2.6%. The positive number is a bounce back from the negative first and second quarter numbers.

What Does All of That Data Add Up To?

The combination of even slightly declining inflation and unemployment releases over the course of October, and then a positive GDP reading for the third quarter, resulted in some much-needed optimism in the equity markets. The values of stocks have been benefiting from historically low interest rates.

Fed Chairman Powell’s relentless campaign of increasing interest rates to tamp down inflation has been having two impacts: the cost of capital for future growth is going up, and the fear that the Fed will overshoot and push the economy into recession compounds with every rate increase. The economic news provided some rationale to believe that the Fed would slow rate increases going forward.

After the FOMC meeting on November 2, The Fed indicated it is prepared to do exactly that. The statement on the rate increase included the key wording “the lags with which monetary policy affects economic activity and inflation.” The was taken to mean that the Fed could potentially decrease the size of rate increases.

The enthusiasm rally in the market was short-lived, as Powell elaborated in the press conference that the overall level of rate increases would likely be higher than previously communicated.

In practical terms, this means that uncertainty shifts from the amount of each monthly or semi-monthly increase in the Fed funds rate, to how many rate increases there will likely be in total. In other words – when will the Fed stop?

And more importantly, will it read the economic tea leaves correctly and stop short of recession?

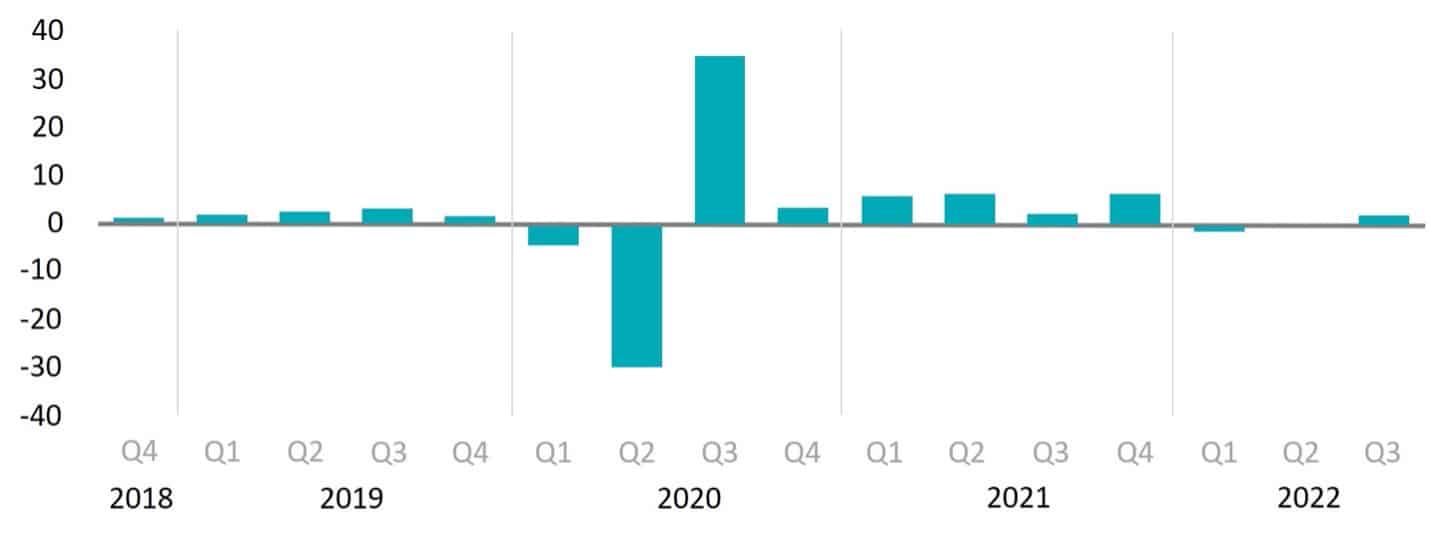

Chart of the Month: Quarterly GDP

Quarterly GDP has rebounded to a more normal, positive level. Two consecutive quarters of negative GDP is one measure of recession, but the overall strength of the economy counterbalanced the dip in GDP in the first and second quarter.

Source: U.S. Bureau of Economic Analysis. Seasonally adjusted rates.

Equity Markets in October

- The S&P 500 was up 7.99%

- The Dow Jones Industrial Average gained 13.95%

- The S&P Mid-Cap 400 returned 10.42%

- The S&P Small-Cap 600 increased 12.27%

Source: S&P. All performance as of October 31, 2022

Earnings reports have begun and are better than expected. Of 276 issues reporting, 191 have beaten estimates on revenue. Q3 2022 is expected to post an 11.9% gain over Q2 2022 and be up 0.8%

over Q3 2021. Sales are expected to set a record, with a 1.9% increase over the Q2 2022

record and up 11.3% over Q3 2022, but this may be due to higher prices. Volatility continues to increase. Daily intraday volatility, measured by the daily high/low, increased to 2.14% from September’s 1.91%. It was 1.28% in August. Year-to-date volatility was 1.88%, compared to 2021 volatility of 0.97%, which was more in line with historical volatility.

Bond Markets

The 10-year U.S. Treasury ended the month at 4.05%, up from 3.84% in September. The 30-year U.S. Treasury ended October at 4.17%, up from 3.78% last month. The Bloomberg U.S. Aggregate Bond Index ended October down 1.29%. The year-to-date return at month end was -15.71%.

The Smart Investor

The Fed’s language on giving the economy time to adjust to rate increases has lowered expectations for the amount of upcoming interest rate moves. A 50-basis point move in December, and again in February now appear likely. Attention has shifted to how long the Fed will continue to increase rates.

Markets will likely remain driven by economic data releases, as we saw with the October payroll number out in early November. This means volatility will be elevated, as the fear of recession is still at the forefront.

As we enter the final months of the year, focusing on good housekeeping in your financial plan is important. High inflation has meant changes to social security benefits, tax brackets, and tax-efficient savings contribution limits.

Taking time to assess where you can take advantage to increase savings or lower your overall tax picture, not just this year, but every year, makes sense.

Good housekeeping chores include:

- Tax planning to take advantage of higher tax brackets

- Utilize increased contribution limits on 401ks and HSAs

- Revisit the amounts you are holding in cash in light of higher interest rates

- Be proactive with year-end portfolio rebalancing and tax-loss harvesting

As always, please reach out to your financial advisor for any questions about current market conditions or if you would like to discuss positions in your portfolio.

Advisory services are offered through TCG Advisors, an SEC Registered Investment Advisor. Insurance services are offered through HUB International. TCG Advisors is a HUB International company.

Note: This message is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Remember all investing involves risk.

Part of this material is prepared by Broadridge Investor Communication Solutions, Inc. Although the information in this blog has been compiled from data considered to be reliable, the information is unaudited and is not independently verified. TCG.69.2022.

Financial assistance is available! Get matched with a Financial Advisor: