March recap and April Outlook

Equity markets, using the S&P 500 index return as a proxy, at first glance appear to have shrugged off the mid-month drama of multiple domestic, regional bank failures and the forced sale of a massive Swiss bank.

Attention was temporarily diverted from the economy’s star attractions, CPI and the Fed, but it quickly came back to the familiar talk track: obsessing over consumer sentiment, inflation, and when the rate hikes will stop.

However, there is definitely a linkage, and while Fed governors are probably not celebrating bank failures, the resulting removal of liquidity from the economy as banks pull back on lending will likely help the Fed contain inflation. But it will also increase the risk of recession, as the Fed will have less control and ability to maneuver with rate hikes.

While this may mean that the Fed may pause on rate increases sooner than expected, for now, the Fed played it safe and went with a 25-basis point hike at the March meeting.

Let’s get into the data:

- 12-month CPI was 6.0% in February. The Bureau of Labor Statistics reported the annual number marked the smallest 12-month increase since September 2021.

- Consumer sentiment fell to 62. The University of Michigan’s preliminary March reading on the overall index of consumer sentiment experienced the first decline in four months but is still higher than any reading since May 2022.

- Consumer confidence in the short term is still below 80. The Conference Board’s Expectations Index captures the short-term outlook for the economy. At a reading of 73, it was higher than in February. But readings below 80 have often signaled a recession is coming in the next year.

What Does the Data Add Up To?

The impact of bank failures is going to take a while to be fully felt in the economy. The pullback in lending is likely already underway as banks trim balance sheets in anticipation of either new regulations or a further weakening economy. To banks, loans are assets, which is why we talk about banks reducing their balance sheets when what’s happening is they are slimming down their loan books.

Deposits have taken a hit for smaller regional banks, and money has moved either to bigger banks or to money market funds, which have experienced large inflows. It may engender another round of bank consolidation, as smaller banks either merge or get bought up by bigger banks.

Regulatory measures will take a while to be discussed, voted on, and implemented. But this doesn’t look like 2008 – 2009. While the economy may have moved closer to recession as the money supply dries up, the markets appear to believe the impact of new banking regulations on regional banks and tighter lending standards won’t be significant outside the financial sector.

What does this mean for the Fed? Chairman Powell actually quantified the impact of bank stress and tighter credit as being “the equivalent of a rate hike or perhaps more than that.” However, he did not go as far as lowering the terminal Fed Funds rate, which remained at 5.1% after the Fed’s March meeting, the same as it was in the last estimate in December. The majority of Fed officials – 10 out of 18 – expect only one more rate increase this year.

Whether this means the Fed will begin cutting sooner than expected or will pause to give the new impacts to the economy time to be felt will be data-dependent. However, the two main inputs of the strong labor market and very slowly deflating inflation aren’t going to give Powell any room for error.

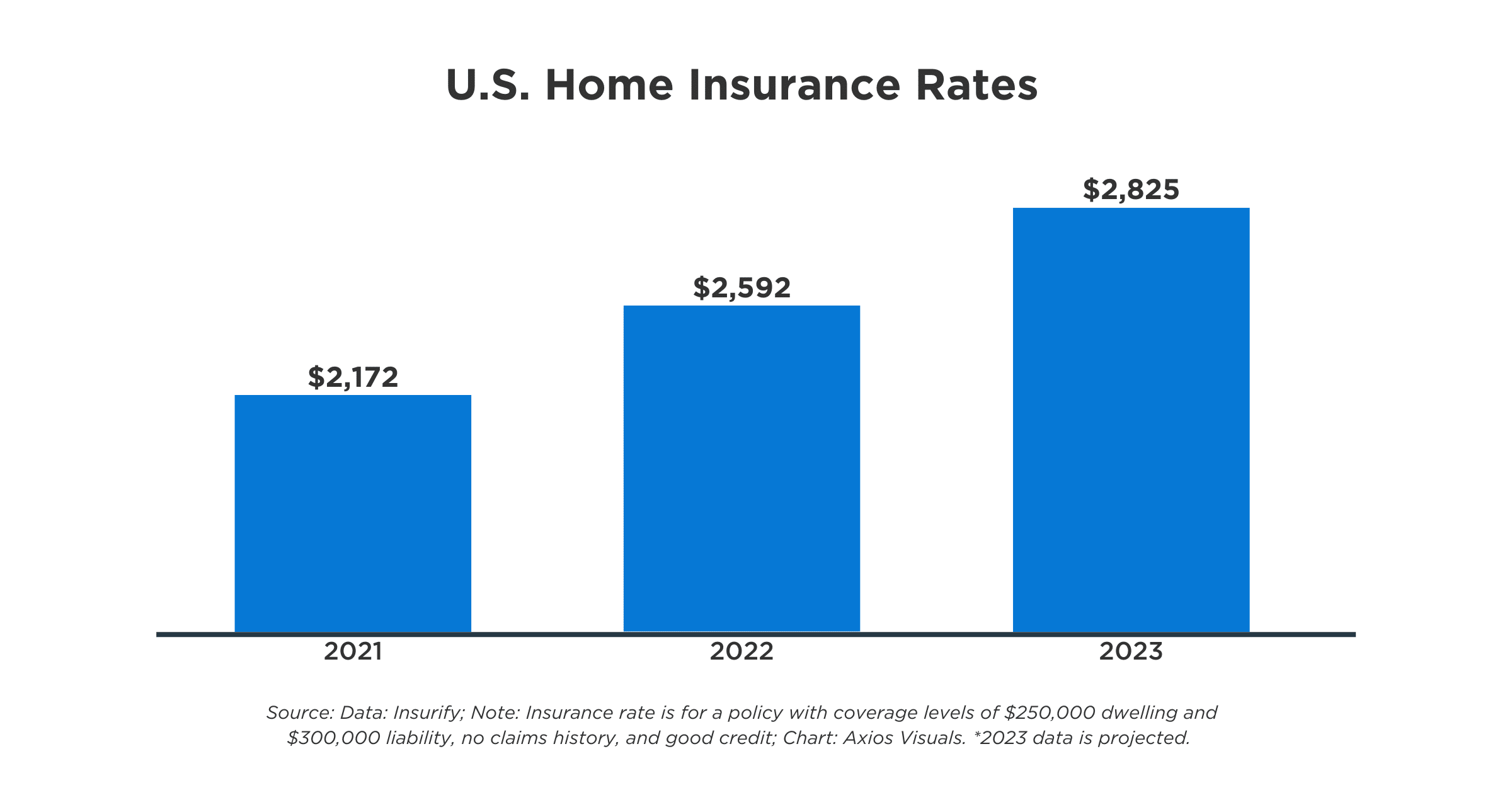

Chart of the Month: The Last Few Years Captured in One Rising Number

Inflation bounced wildly up, housing prices increased, and the cost of materials to build or repair houses also skyrocketed due to supply chain disruptions. The one number to capture them all? Your homeowner’s insurance.

Equity Markets in March

- The S&P 500 was up 3.51%

- The Dow Jones Industrial Average rose 1.89%

- The S&P Mid-Cap 400 returned -3.41%

- The S&P Small-Cap 600 returned -5.38%

Source: S&P. All performance as of March 31, 2023

After taking a beating throughout the rate hikes of the last year, the poster children for growth stocks – Information Technology – had a gain of 10.93% which added 2.97% to the S&P 500 Index’s return and helped overcome Financials’ 9.55% drop for the sector and 1.13% cost to the index. The first quarter return was 7.50% for the overall index.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 3.48%, a drop from February’s 3.98 and almost even with the end of January. The 30-year U.S. Treasury ended February at 3.92%, down from 3.66% last month. The Bloomberg U.S. Aggregate Bond Index ended March with a return of 2.53% and is positive for the quarter at 2.96%. The equity and bond markets remain positively correlated.

The Smart Investor

Tax season can be exhausting even for people who aren’t CPAs. But before you put those tax thoughts away for another year, take a minute to see if there’s anything you can do differently for next year.

- Are you taking advantage of tax-efficient savings in HSAs, FSAs, and retirement plans?

- How about savings for kids’ college? If your state offers a tax break for a 529 plan – even if you haven’t been saving for years, you may be able to fund one and then take the money out in the same year to pay college costs and avail yourself of the tax break

- Are you setting up lower taxes in retirement by converting to a Roth account?

- Are you taking advantage of the spousal IRA provisions, if only one spouse is working?

- How about charitable giving? Getting a plan in place now can eliminate year-end scrambles

- Are you planning any asset sales this year? How will you structure them?

- Is your estate plan in place? Have you set up a trust?

The goal for tax planning isn’t to lower your taxes in any one year – it’s to plan ahead and pay as little in taxes as possible over the course of your working life and your retirement and then pass on as much as possible to your loved ones.

DISCLOSURES

Advisory services are offered through TCG Advisors, an SEC Registered Investment Advisor. Insurance services are offered through HUB International. TCG Advisors is a HUB International company.

Note: This message is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Remember all investing involves risk.

Part of this material was prepared by Broadridge Investor Communication Solutions, Inc. and powered by Advisor I/O under the Terms of Service. Although the information in this blog has been compiled from data considered to be reliable, the information is unaudited and is not independently verified. TCG.38.2023