August Recap and September Outlook

For most of the summer, increasingly positive data releases fed into the market’s upbeat view of the economy. This seemed to contradict the consistent messaging from the Federal Reserve that it isn’t done raising rates and inflation isn’t yet defeated.

August poured cold showers on the market’s optimism, as Jerome Powell continued his new tradition of using his speech at the Jackson Hole Symposium to amplify a hawkish message on the likely path of monetary policy.

While the market certainly wasn’t surprised, a growing feeling that the strength of the economy, driven by a consumer that isn’t slowing down spending, may keep the Fed from reversing course anytime soon.

Inflation didn’t trend down in July compared to June, coming in at 3.2%.

How can a strong economy be bad news? It’s all relative.

Let’s get into the data:

- August non-farm payrolls were 187,000. The Bureau of Labor Statistics released the August jobs report, and also reported unemployment increasing to 3.8%.

- Consumer spending increases outpaced personal income. The Commerce Department reported personal incomes rose 0.2% in July, while consumer spending rose 0.8%.

- The market isn’t expecting a rate cut in 2023. As of August 25th, prices on the Fed Funds future market were indicating only a 2% chance of a rate cut – down from 40% in June.

- The personal savings rate fell to 3.5% in July. In June, the rate was 4.3%.

What Does the Data Add Up To?

Inflation is heading down to the Fed’s stated target of approximately 2%, GDP is holding steady at 2.1%, and the red-hot jobs market we’ve seen for the past several years is finally cooling.

Instead of a recession, the economy is healthy and appears poised for slow, but sustainable, growth. This is pretty close to the soft landing that Jerome Powell consistently insisted was achievable. For a long time, it looked like his views on the potential for a soft landing were as wrong as his belief that inflation would be “transitory.” But as the year has ripened, the consumer has proved to be very durable, and inflation did ultimately respond as the post-pandemic economy normalized and the impact of rate hikes began to be felt.

The fear now is that Powell will keep rates higher for an extended period of time, to ensure that inflation falls further and stays down. This will likely be felt in corporate profit margins, and higher rates are one factor driving mortgage rates ever higher.

Can consumer spending continue to prop up the economy, or will inflation continually outpacing income take a toll? Consumers are currently spending instead of saving, as seen by the falling personal saving rate. More fragile consumer balance sheets will eventually have an impact on the economy.

Falling inflation is usually coupled with rising unemployment. It’s called the “sacrifice ratio.” The unemployment rate has stayed low even as inflation has dropped precipitously because the labor market was so hot. This month saw an increase in unemployment from 3.5% to 3.8%, driven by a higher labor force participation rate. Getting inflation down further may mean more pressure on unemployment.

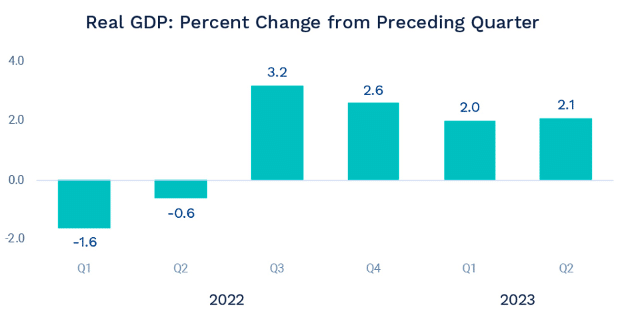

Chart of the Month: GDP Describing a Soft Landing

GDP recovered from the two negative quarters of early 2022 and has been holding steady – with no sign of a recession. It’s starting to look very much like a glide path for the economy and the “unicorn” soft landing.

Source: U.S. Bureau of Economic Analysis. Seasonally adjusted annual rates.

Equity Markets in August

- The S&P 500 was down 1.77%

- The Dow Jones Industrial Average fell 2.36%

- The S&P MidCap 400 declined 3.04%%

- The S&P SmallCap 600 was down 4.33%

Source: S&P Global. All performance as of August 31, 2023

After five consecutive months of gains, the S&P 500 posted losses on 14 of 23 trading days in August. Ten of the eleven S&P 500 sectors were down. Energy was in the lead again, up 1.28% for the month. Utilities was the worst performer, down 6.72%. Earnings season brought good news, up 4.5% compared to the expected slight decline. At month end, 98% of the market value of the S&P 500 had reported earnings, with 374 issues of a total 496 beating expectations.

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 4.11%, up from 3.96% the prior month. The 30-year U.S. Treasury ended August at 4.21%. The Bloomberg U.S. Aggregate Bond Index returned -0.63%, with a year-to-date return of 1.37%.

The Smart Investor

Summer isn’t officially over, but the days are shorter and the temperatures are hopefully getting cooler. As you get closer to year end, there will be a lot of actions you need to take, like topping up your 401(k) and planning charitable giving. Back-to-school brings homework to kids, and investors should also spend some time doing their portfolio homework of reviewing statements and allocations.

But before you get busy on the actions you need to take, take advantage of this reflective time of year to think about your goals.

Your goals are what drive every other element of your investing plan. Have they changed? How do you know unless you really revisit them? Some questions to ask yourself:

- Has your financial situation changed? New job, inheritance, any other changes?

- How about your family? Kids starting college and moving out?

- What’s going on with your home? If you had plans to upsize (or downsize) are they on hold given the current real estate market and ever-increasing interest rates?

- How are your parents doing? Still aging gracefully, or are you getting a little concerned?

- How do you feel about your job? Is early retirement getting more appealing?

- How about your portfolio? Do your investments reflect your values?

These are just some of the things you should think through when you start to work on your investment plan. These things all change over time, and even small differences can alter your timeline, or indicate a different risk profile may be needed, or perhaps you need to revisit your budget, your cash flow plan or your overall strategy.

It’s a good time, before the holiday season kicks off, to take stock of your goals and make a plan to stay on track.

IMPORTANT DISCLOSURES

Advisory services are offered through TCG Advisors LLC, a HUB International company, an SEC Registered Investment Advisor. Insurance services are offered through HUB International.

Note: This message is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Remember all investing involves risk.

Part of this material was prepared by Broadridge Investor Communication Solutions, Inc. and powered by Advisor I/O under the Terms of Service. Although the information in this blog has been compiled from data considered to be reliable, the information is unaudited and is not independently verified. TCG.176.2023