Imagine a small seed that you plant in your backyard. You water it diligently and tend to it with care. As time passes, that seed grows into a magnificent tree, providing shade, beauty, and possibly even fruit. Now, let’s apply this concept of growth to your finances through the magic of compound interest. Just as a tree flourishes through the years, your money can multiply itself over time, resulting in a financial bounty you might never have dreamed possible. Welcome to the world of compound interest – a financial concept that holds the potential to turn your financial future into something truly remarkable.

Understanding the Basics

Let’s start by demystifying the term “compound interest.” In its simplest form, it’s the interest you earn on both your initial investment (the principal) and any accumulated interest. In other words, it’s interest on interest, and it’s what makes your money grow faster than you might think. The longer you let it work its magic, the more powerful its effects become.

Let’s break it down with a real-life example: saving for retirement. Imagine you start by investing $1,000 in a retirement account with an annual interest rate of 8%. In the first year, you’d earn $80 in interest (8% of $1,000). But here’s where the real magic happens: in the second year, you earn 8% on not just your initial $1,000, but also on the $80 you earned in the first year. That’s $8.80 in interest, bringing your total to $1,088.80. As this cycle continues, your money begins to snowball, and the growth becomes exponential.

The Power of Time

Albert Einstein once referred to compound interest as the “eighth wonder of the world.” Why? Because it can turn even modest contributions into substantial wealth over time. The key ingredient here is time – the longer your money has to compound, the more impressive the results. Let’s dive into another example to illustrate this point.

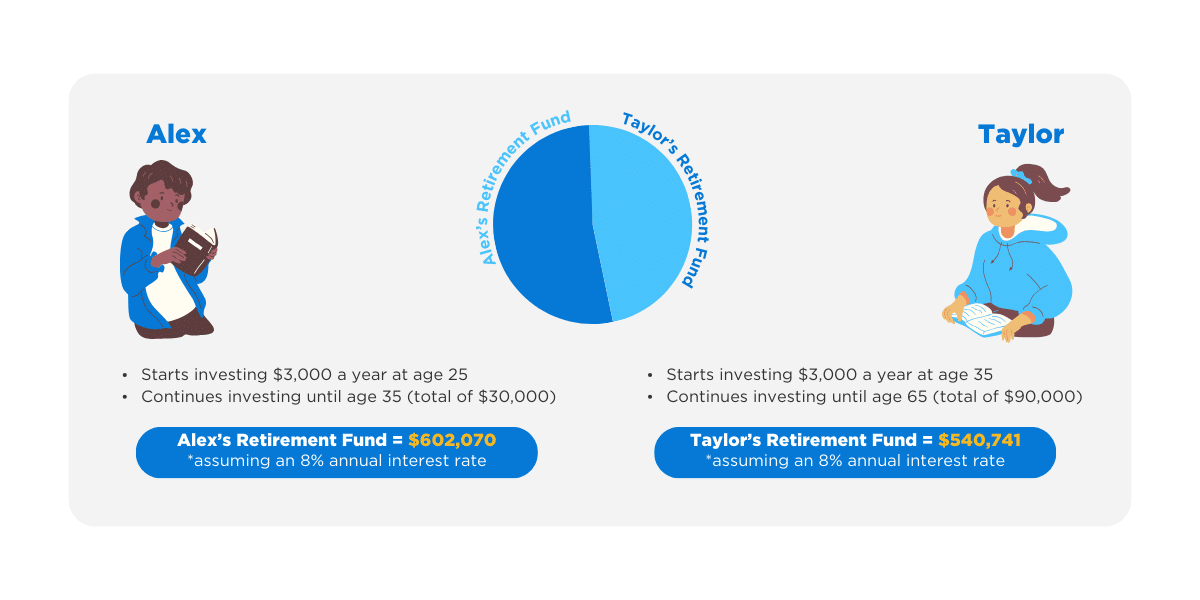

Meet Alex and Taylor, two friends who have different approaches to saving for retirement. Alex starts investing $3,000 every year at age 25 and continues until age 35, a total of $30,000. Taylor, on the other hand, begins investing the same amount but starts at age 35 and contributes until age 65, a total of $90,000. Assuming an 8% annual interest rate, let’s see how their retirement funds stack up at age 65.

- Alex’s retirement fund would grow to approximately $602,070.

- Taylor’s retirement fund, despite contributing three times as much as Alex, would reach around $540,741.

The astonishing difference between the two accounts isn’t just the amount invested, but the power of compound interest over a longer period. Alex’s money had more time to multiply itself, resulting in a more substantial nest egg despite contributing less overall.

Harnessing the Magic

So, how can you harness the magic of compound interest to secure your financial future? Here are a few practical steps that the average American can take:

Start Early: The Power of Time

The concept of “time in the market” is one of the most significant factors in harnessing the power of compound interest. When you start investing early, your money has more time to grow, benefiting from multiple compounding cycles. Even if you can only invest a small amount initially, the cumulative effect of compounding can turn those small contributions into substantial sums over the long term. This early start can be particularly advantageous for retirement savings, as it allows you to take advantage of decades of growth.

Imagine two individuals, Sarah and John. Sarah starts investing $100 per month at age 25 and continues until age 65. John, however, waits until age 35 to start investing the same amount. Assuming an 8% annual return, by age 65, Sarah would have approximately $289,000, while John would have around $146,000. Sarah’s decision to start a decade earlier allowed her to more than double her final amount despite contributing only $12,000 more in total.

Consistency is Key: Regular Contributions

Consistency is a crucial aspect of harnessing compound interest. Regular contributions ensure a steady stream of funds flowing into your investments, allowing them to continuously benefit from compounding. Setting up automatic transfers to your retirement account or investment portfolio can help you maintain this consistency, regardless of market fluctuations or other financial pressures.

For instance, let’s say you invest $1,000 every month for 30 years with an average annual return of 7%. At the end of this period, your total investment would be $360,000, but your portfolio would have grown to approximately $1.13 million, highlighting the impact of consistent contributions and compounding.

Take Advantage of Retirement Accounts

Retirement accounts, such as 401(k)s, 457(b)s, 403(b)s, and IRAs (Individual Retirement Accounts), offer unique advantages for harnessing compound interest. Employer-sponsored plans often come with matching contributions, where your employer adds to your retirement fund based on your contributions. This is essentially free money that you’re leaving on the table if you don’t contribute enough to receive the full match.

Additionally, retirement accounts provide tax benefits. Traditional accounts offer tax-deferred growth, meaning you won’t pay taxes on your earnings until you withdraw the money during retirement. Roth accounts, on the other hand, allow for tax-free withdrawals in retirement, as you’ve already paid taxes on the contributions. These tax advantages can significantly enhance the growth potential of your investments.

Diversify Your Investments

Diversification involves spreading your investments across a range of asset classes, such as stocks, bonds, and real estate. This strategy helps manage risk and potentially increases returns by taking advantage of various market opportunities. Diversification complements compound interest by safeguarding your investments from the volatility of individual assets. By including different types of investments in your portfolio, you’re more likely to experience consistent growth over time.

Let’s say you have $50,000 to invest. Instead of putting all your money into a single stock, consider diversifying across stocks, bonds, and real estate investments. If one asset class experiences a downturn, the others may remain stable or even grow, reducing the overall impact on your portfolio’s value and supporting your compound interest gains.

Avoid Touching Your Investments

While it might be tempting to withdraw funds from your investments for short-term needs or desires, doing so can disrupt the compounding process. Every withdrawal reduces the principal amount available for future compounding, potentially slowing down your growth rate. To maximize the benefits of compound interest, it’s advisable to leave your investments untouched and allow them to grow over time.

If you need funds for an emergency or specific goal, explore alternative options, such as building an emergency fund or creating separate savings accounts for short-term objectives. By protecting your investments from unnecessary withdrawals, you ensure that compound interest can work its magic to its fullest extent.

Educate Yourself

Knowledge is a powerful tool in the world of finance. Take the time to educate yourself about different investment options, compounding frequencies, interest rates, and market trends. Understand the risks and rewards associated with various investment choices, and seek guidance from financial advisors if needed. An informed investor is better equipped to make sound financial decisions that align with their goals and maximize the potential of compound interest.

By continually learning about personal finance and investment strategies, you can adapt your approach as circumstances change and opportunities arise. Staying informed empowers you to make informed decisions that can have a positive impact on your long-term financial well-being.

In Conclusion

Harnessing the magic of compound interest requires a combination of strategy, discipline, and patience. Starting early, maintaining consistent contributions, taking advantage of retirement accounts, diversifying investments, avoiding unnecessary withdrawals, and educating yourself are all key components of a successful approach. As you embark on your financial journey, keep in mind that the power of compounding can transform even modest contributions into substantial wealth over time. By following these principles and nurturing your investments, you can set yourself on a path towards financial security, freedom, and the achievement of your long-term goals. Remember, the earlier you start, the more time you have to witness the astonishing growth that compound interest can bring to your financial life.

DISCLOSURES

Investment advisory services offered through TCG Advisors LLC, a HUB International company, an SEC registered investment advisor. Insurance Services offered through HUB International. Tax services offered through RPW Solutions. Although the information in this blog has been compiled from data considered to be reliable, the information is unaudited and is not independently verified.

Tax services offered through RPW Solutions. TCG Advisors does not provide tax, legal or accounting advice. This presentation was prepared for information purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisor before engaging in any transaction.

Any information is for illustrative purposes only and is not intended to serve as investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances.

As with any investment strategy, there is potential for profit as well as the possibility of loss. TCG does not guarantee any minimum level of investment performance or the success of any portfolio or investment strategy.

All investments involve risk and investment recommendations will not always be profitable. Past performance is no guarantee of future results. Investment returns and principal values of an investment will fluctuate so that an investor’s investment may be worth more or less than its original value.

This website is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments. This website is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. TCG.174.2023