June Recap and July Outlook

At the FOMC meeting in mid-June, the story was the drop in expectations for multiple rate cuts in 2024 to potentially only one rate cut later in the year. However, positive data around inflation and labor markets appears to have counteracted market pessimism about the cautious nature of the Fed’s messaging.

As we hit the mid-point of the year, the economy appears to have been able to sustain a soft landing so far. With a Fed still undecided on rate cuts and waiting on data, as well as continued heightened geopolitical risk and an election season that is already dramatic, what is in store for the balance of 2024?

Let’s get into the data:

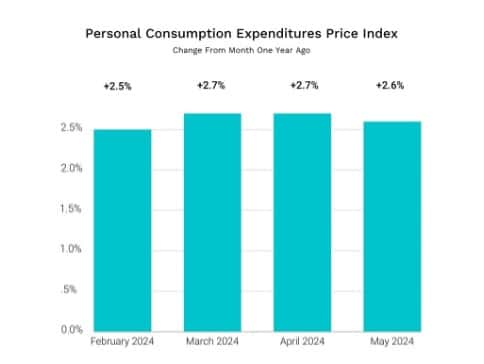

- PCE Inflation, the Fed’s preferred measure, declined from the level seen earlier this year. PCE rose 2.6% for the 12 months through May, lower than April’s 2.7%.

- Consumer spending inched back up. May retail sales were up 0.1% overall, and up 0.3% if plunging gas station sales are excluded. Spending in housing-related categories, including furniture shops and building stores, also declined.

- Second quarter 2024 GDP estimates have moderated. On July 3rd, the Federal Reserve Bank of Atlanta’s GDPNow estimate was 1.5%. As of mid-June, this estimate was over 3%.

- Non-farm payrolls increased by 206,000 jobs in June. The Labor Department’s Bureau of Labor Statistics report was above consensus expectations, but May gains were revised down sharply to 218,000 from 272,000.

What Does the Data Add Up To?

After a return to increasing inflation in the first quarter, the June data shows inflation trending back down, and a moderating of the strong labor conditions we’ve seen for some time.

Reducing inflation to where it can be sustained at a level close to 2% has been the priority for the Fed. Inflation impacts all segments of the economy, but particularly the most vulnerable, and Chairman Powell has been vocal about the Fed’s goals. However, with inflation lower, the costs to consumers of sustained high interest rates are also beginning to be felt, as consumer have run through savings surpluses and are now supporting spending through higher credit card balances that are accruing interest at much higher rates.

The Fed has been talking about the labor market a lot, and the recent numbers finally show a cooling trend. The downward revisions from previous month’s data in the second quarter now show a three-month average of job gains of roughly 177,000 — much lower than the 269,000 seen in the first quarter.

The tick up in the unemployment rate to 4.1% in June, from 4.0% in May is small, but it’s significant that the rate has remained above 4.0%. This is higher than it has been since 2021. The Fed’s balancing act is to provide relief from inflation, but without exacting a toll on consumers through rising unemployment.

At this phase in the cycle, the risks to the Fed’s inflation and employment goals of low inflation and full employment “have come back much closer to balance” according to Powell.

The Fed will be data dependent as always, but if inflation continues to moderate, the Fed may feel that more than one rate in the second half of 2024 will help to keep the economy in balance.

Chart of the Month: The Fed’s “Disinflationary Path”

Toward the end of the month, Chairman Powell appeared more positive when speaking at a monetary policy conference sponsored by the European Central Bank. He referred to the U.S. as being on a “disinflationary path.”

Source: Bureau of Economic Analysis

Equity Markets in June

- The S&P 500 was up 3.47% for the month and 14.48% YTD

- The Dow Jones Industrial Average rose 1.12% in June and was up 3.79% YTD

- The S&P MidCap 400 returned -1.77% for the month, but was positive 5.34% YTD

- The S&P SmallCap 600 fell -2.46% and the first half return was -1.61%

Source: S&P Global. All performance as of June 30, 2024

Only five of eleven S&P 500 sectors gained in June. The “Magnificent 7” stocks (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) accounted for 79% of the return for the month. Q1 2024 S&P 500 earnings season closed with 77% of issues beating operating earnings estimates. For Q2 2024, the expectation is to increase 6.6% over Q1.

Source: S&P Global. All performance as of June 30, 2024

Bond Markets

The 10-year U.S. Treasury ended the month at a yield of 4.39%, down from 4.51% the prior month. The 30-year U.S. Treasury ended June at 4.55%, down from 4.765%. The Bloomberg U.S. Aggregate Bond Index returned 0.95%. The Bloomberg Municipal Bond Index returned 1.53%.

Source: YCHARTS. All performance as of June 30, 2024

The Smart Investor

Is your financial plan meeting your goals? Your portfolio might be hitting or exceeding its benchmarks, and may be in alignment with your risk tolerance. Those are table stakes. The bigger question is whether your overall plan is going to help you get where you want to go. But you can’t determine that until you really know what your goals are. Some things to think through that can have a very big impact on your plan:

- How long do you want to work? Do you want to retire early, take a sabbatical, have one spouse scale back work, or some other configuration? Will your plan create the flexibility for you to do that?

- Is your career everything you want it to be? Are you getting the most out of job? Are you maximizing your benefits?

- If you are at the point where you have excess income after paying off bills and hitting savings goals – what do you want to do with it? What’s most important to you? Fully funding kids education, buying a family vacation home, having a lot of great experiences while your kids are young?

- What keeps you up at night? Is your family protected?

A great relationship with a financial advisor is one where you feel comfortable surfacing all these questions, and more. We’re always here to help.

IMPORTANT DISCLOSURES

Investment advisory services offered through TCG Advisors, an SEC registered investment advisor. Insurance Services offered through HUB International. Recordkeeper and Third Party Administrator services offered through TCG Administrators, a HUB International Company. FinPath is offered through RPW Solutions.

HUB International, owns and operates several other entities which provide various services to employers and individuals across the U.S.

Employees of HUB International may offer securities through partner Broker Dealers not affiliated with HUB. Employees of HUB International provide advisory services through both affiliated and unaffiliated Registered Investment Advisors (RIA). Global Retirement Partners, LLC, HUB Investment Advisors, TCG Advisors, Millennium Advisory Services, and Sheridan Road Advisors, LLC are wholly owned subsidiaries of HUB International.

This is not authorized for use as an offer of sale or a solicitation of an offer to purchase investments in any of the plans discussed or an affiliated entity. An investment in the plans carries the potential for loss. This presentation is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction.