Tariffs, Inflation, and Taxes: Where’s the Balance?

February Recap and March Outlook

The new administration’s priority of “reindustrializing the U.S.” is coming into focus as tariff announcements – even if softened or rescinded – indicated that this is a policy, not just a campaign plank. Throughout the month, the Department of Government Efficiency (“DOGE”) continued its mandate of shrinking government with a raft of layoffs. Headlines on these two topics led to growing fears that an increasingly pessimistic consumer would stop spending, and that inflation would begin to spike once more. While the market response throughout February was to react with higher volatility, equities largely closed out February with only moderate losses.

The balance is between the Fed’s fight against inflation, which seems to have entered a new but familiar chapter of climbing back up, along with the re-emergence of recessionary pressures in the form of weaker labor markets that may complicate the decision on interest rates.

Let’s get into the data¹:

- Inflation, as measured by CPI, rose above expectations. CPI rose 3.0% for the 12 months ended in January. The monthly number rose 0.5%, against expectations for a 0.3% increase and the highest since jump since August 2023.

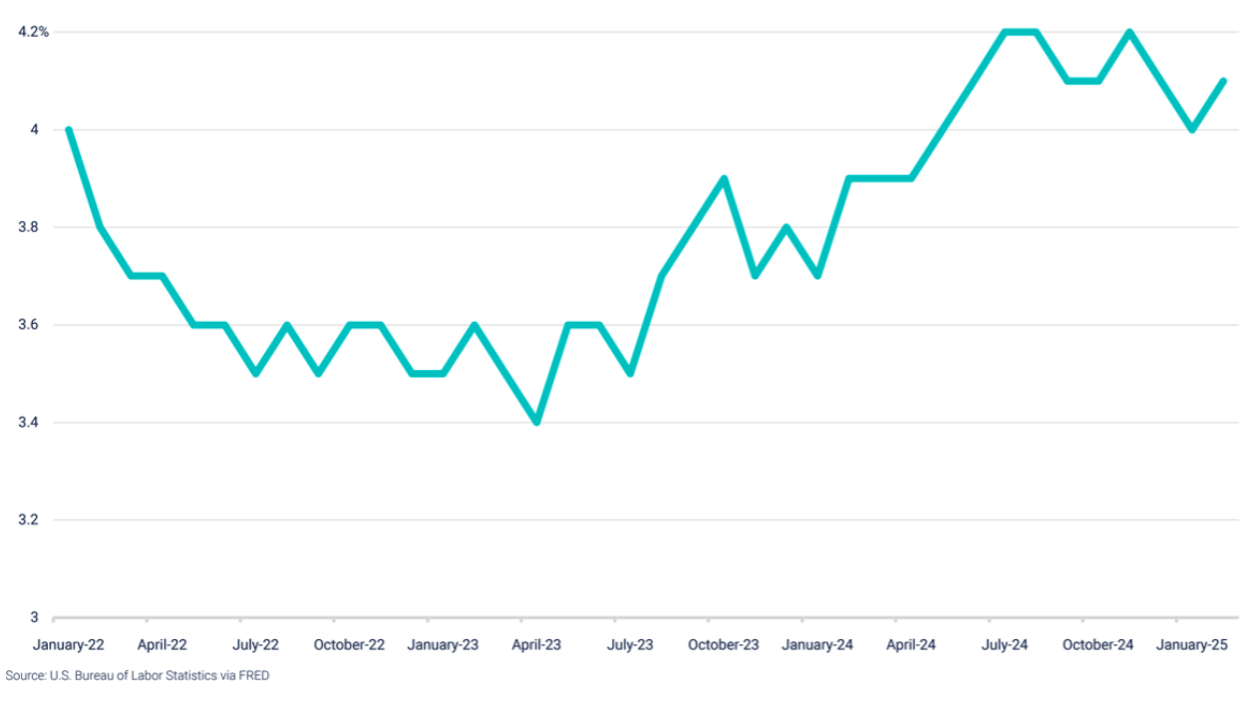

- Non-farm payrolls for February came in at 151,000. The U.S. Bureau of Labor Statistics reported fewer than the 170,000 jobs that were expected, and the unemployment rate rose to 4.1%

- Consumer confidence declined. The Conference Board Consumer Confidence Index® declined by 7.0 points in February, marking the third straight month of increased pessimism.

- Unemployment expectations jumped 5.4 percentage points. The New York Fed’s Survey of Consumer Expectations reported the probability of the U.S. unemployment rate being higher in one year was at the highest level since September 2023.

When Markets Panic, Look at the Bigger Picture

When markets experience sell-offs, it’s important to step back and consider the broader historical perspective. Since 1928, the S&P 500 has only declined more than 10% in a calendar year 12 times², with nearly all instances tied to severe recessions, wars, or significant policy missteps.

1. Severe Recessions

- Historically, the majority of double-digit S&P 500 declines have been linked to recessions.

- February’s jobs report showed 151,000 jobs added, with the unemployment rate at 4.1%. While data can shift quickly, these figures don’t currently indicate an imminent recession.

- That being said, economic data has started to slow, and many companies have lowered Q1 earnings guidance. Analyst projections for the second half of 2025 still reflect near all-time highs, but the market is beginning to reassess whether those earnings expectations need to come down.

2. Wars and Geopolitical Tensions

- Three of the 12 major S&P 500 annual declines were due to World War II (1940, 1941) or geopolitical instability (2002)³.

- Currently, the probability of the U.S. entering a major war appears lower than in recent history, given the new administration’s stated priorities.

3. Significant Policy Mistakes

- The administration’s evolving tariff strategy is being closely watched by the market. Initially, many investors assumed tariffs would be used as a negotiation tactic, but prolonged trade disputes could have broader economic implications.

- Canada and Mexico have not backed down, and additional reciprocal tariffs are set to take effect on April 2. The market is still digesting whether the combination of spending cuts and tariffs is the right mix to sustain growth without driving further volatility.

When/Why Bad Things Happen to Good Markets

- Since 1928 (97 years), the S&P 500 has been down more than 10% only 12 times on a total return basis.

- 8 were due to recession (1930, 1931, 1937, 1957, 1973, 1974, 2001, 2008)

- 3 were due to World War II (1940, 1941) or major geopolitical tensions (2002)

- 1 was due to a Fed rate shock that didn’t cause a recession (2022)

What Does the Data Add Up To?

The Trump administration is hoping to find balance between consumer perceptions that could become unfortunate reality in the form of higher inflation and struggling equity markets, and the competing mandates of attempting to reindustrialize the U.S. through tariff policies while reducing taxes. Resizing the government workforce has become something of a wild card. It hasn’t impacted labor markets or budgets yet, but it has the potential through public perception to complicate getting the administration’s agenda through Congress.

The labor market report⁴, out on Friday, March 7th, showed a labor market that is weakening somewhat, but is still on firm footing. The Atlanta Fed’s GDPNow is telling a very different story. The official estimate of GDP is released with a delay, and the GDPNow is described as a forecasting model that provides a “nowcast” of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis.

As of March 6th, the reading was -2.4% GDP Growth in Q1. These estimates can be quite volatile and are probably not enough to start serious consideration that the economy is headed towards a recession. In contrast, the NY Fed’s GDP Nowcast was at 2.67% GDP growth on Friday, March 7th. The Atlanta Fed is considered the most reliable of the estimators of GDP, but this may be a very short-term signal.

Of more concern than outright recession is the potential for stagflation, which is a portmanteau word for when the economy is experiencing stagnant growth and rising inflation. Tariffs create a supply shock, which tends to reduce growth while putting upward pressure on prices. The language from the administration is so far committed to the policy of change through tariffs and is cautioning that there will be a “period of transition.” However, with inflation already higher, the Fed may not have much room to maneuver with rate cuts to keep the economy growing.

Chart of the Month: A Slight Uptake in Unemployment as Non-Farm Payrolls Miss

Unemployment rates in the U.S.

Source: U.S. Bureau of Labor Statistics via FRED

Equity Markets in February⁵

- The The S&P 500 was down 1.42% for the month

- The Dow Jones Industrial Average fell 1.58% for the month

- The S&P MidCap 400 decreased 4.44% for the month

- The S&P SmallCap 600 lost 5.84% for the month

Source: S&P Global. All performance as of February 28, 2025

Q4 2024 S&P 500 earnings were a bright spot, reporting stronger than expected and projected to post a new quarterly record. As of the end of February, 484 issues have reported, representing 96.8% of the market value, with 359 beating for a historically high 74.2% beat rate. In February, six of the eleven S&P sectors gained, with Consumer Staples out front with a 5.59% return⁶. Consumer Discretionary was the worst, down 9.94%, perhaps reflecting a more pessimistic consumer.

Bond Markets in February

The 10-year U.S. Treasury ended the month at a yield of 4.21%, down from 4.55% the prior month. The 30-year U.S. Treasury ended December at 4.49%, up from 4.80%. The Bloomberg U.S. Aggregate Bond Index returned -1.41%. The Bloomberg Municipal Bond Index returned 0.13%⁷.

The Smart Investor

Volatility is back, and until there is more clarity on the extent of the administration’s policy on and commitment to tariffs, the markets will likely be responding to headlines as much as to incoming data.

What can investors do to smooth volatility?

- Review your risk/return targets and be sure your asset allocation matches them. With the market up significantly last year, you may not have wanted to trim positions that were working. However, with heightened volatility, you may want to keep your risk to a level that allows you to be sure you are on track for your goals, while letting you sleep at night.

- Review your personal situation. Has anything changed? Do you have big expenses coming up that you were planning on funding from investments? Keeping more in cash when things are volatile can ensure that you don’t have to sell into a falling market.

- Similarly, if you are planning on investing your tax return or an annual bonus, consider dollar cost averaging, where you invest smaller amounts consistently over time, to avoid investing and having the market go south on your entire investment.

Combining personal goals, investments, and a view on the economy, while ensuring that all the pieces of the financial planning process are engaged, is at the core of what a financial advisor can bring to the table. We’re always here to help.

IMPORTANT DISCLOSURES

Investment advisory services offered through HUB Investment Partners LLC, an SEC registered investment advisor f/k/a TCG Advisors LLC. Insurance Services offered through HUB International. HUB International, owns and operates several other entities which provide various services to employers and individuals across the U.S.

Note: This message is for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation for any security, or as an offer to provide advisory or other services in any jurisdiction in which such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. Remember all investing involves risk.

Part of this material was prepared by Broadridge Investor Communication Solutions, Inc. and powered by Advisor I/O under the Terms of Service. Although the information in this blog has been compiled from data considered to be reliable, the information is unaudited and is not independently verified.

Sources:

- CPS Home : U.S. Bureau of Labor Statistics

- Three catalysts have driven S&P 500 corrections since 1964. Here’s what could spark one now. | MarketWatch

- Stock Market Crashes: A Look at 150 Years of Bear Markets | Morningstar

- GDP Now | Federal Reserve Bank of Atlanta

- Federal Reserve Bank of New York

- Thinking of Investing Abroad? You’d better read this first | Barrons

- What 125 years of data says about diversification and investing at record highs | Bloomberg