In volatile times like these, individuals like yourself experience the value of having a financial plan in place designed to meet financial goals through any market condition. Allowing you to focus less on financial stress and more on what matters most: a happy and healthy family.

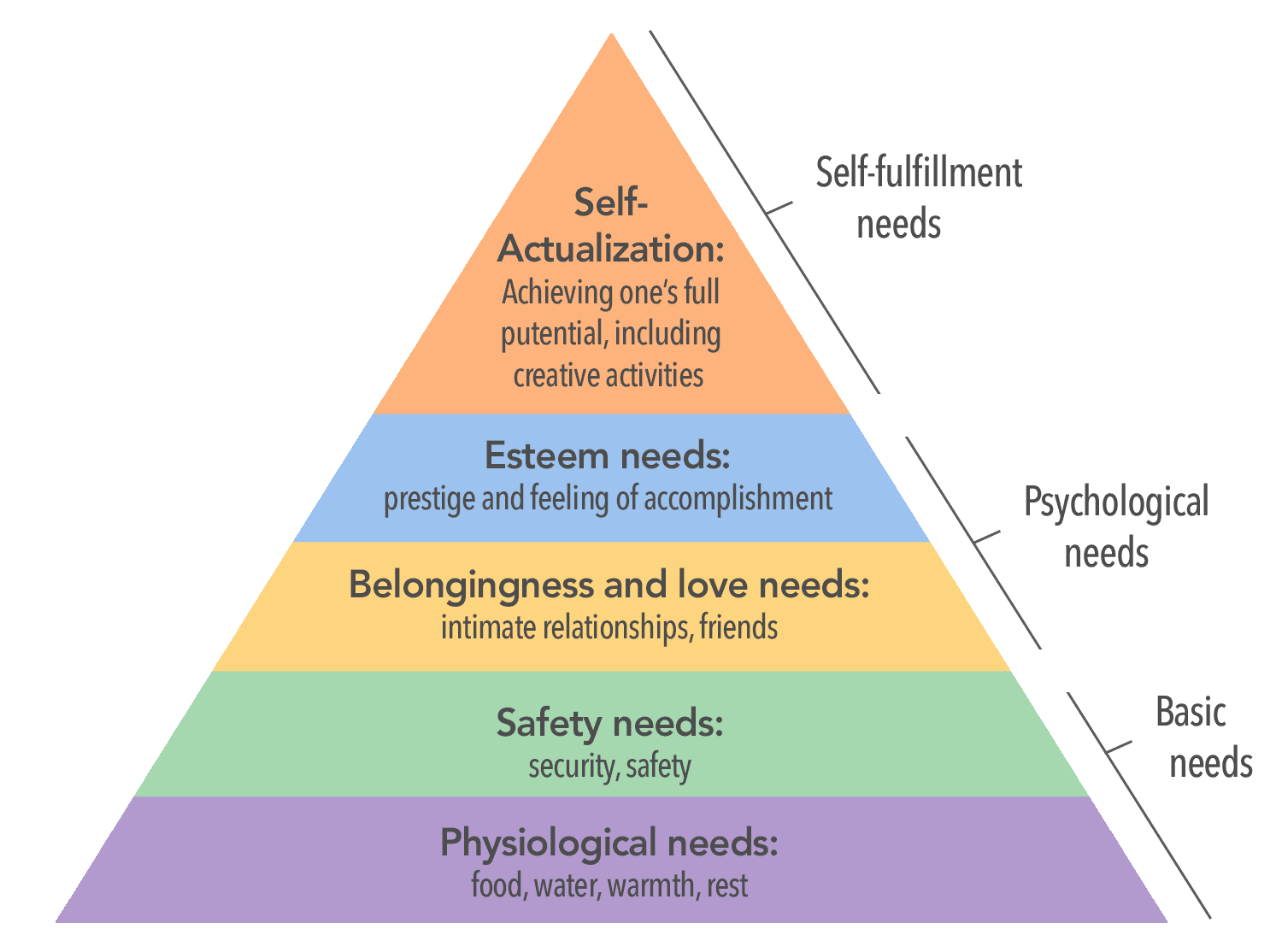

Money is a central theme in the day to day decisions of most Americans. When you are worried about being able to meet your basic needs (food, water, warmth, rest) and psychological needs (security and safety) your higher-level needs are likely to suffer. The goal of financial wellness is to get to a point where both your bottom line and overall health and well-being thrive.

See the diagram below for a holistic wellbeing guide.

Financial well being falls under psychological needs which includes your relationship with money, skills to manage resources to live within your means, making informed financial decisions and investments, setting realistic goals and learning to prepare for short and long term needs or emergencies. If these items are ignored, stress can begin to accumulate.

Financial stress can lead to a variety of health problems including high blood pressure, headaches, stomach problems, anxiety, depression, and increase chances of type 2 diabetes. FinPath provides the tools you need to tackle day to day life: budgeting tools, FinPath University Courses, and one-on-one coaching. During times of stress, you are not alone. TCG is your partner during all market conditions.

FinPath provides financial wellness guidance to improve your holistic wellness. Our team of experts wants to help you seek satisfaction with both your current and future financial decisions.