Help your staff achieve financial wellness with access to FinPath

Where can your staff go to get help and have a conversation about their money?

A friend? A family member? A payday lender?

Can they really look out for them and help them manage financial stress?

Without a trusted source, financial stress can have long-term negative impact

Missed payments

Low credit scores

No emergency savings

Poor retirement savings

Emotional and physical stress

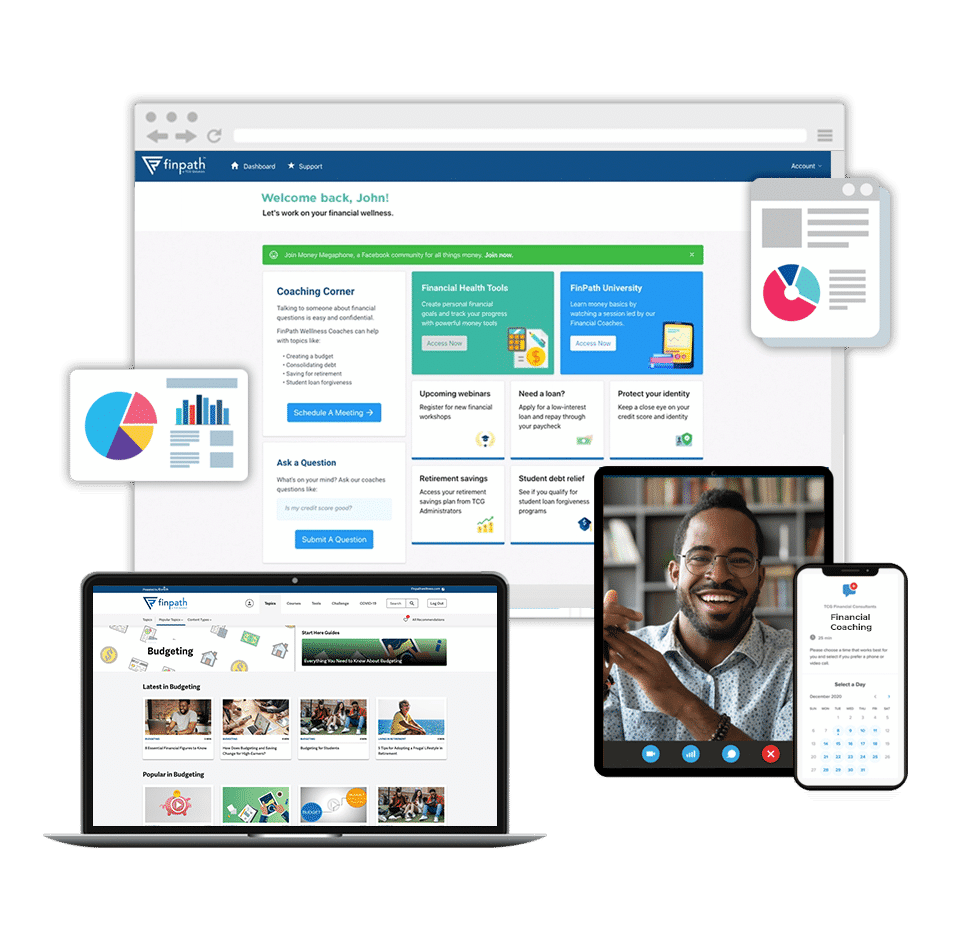

Give your employees access to every tool needed for financial success

FinPath brings your staff the following resources:

- Access to unbiased financial coaches

- Unlimited phone and virtual appointments

- Financial education courses

- Online budgeting and financial planning tools

- Monthly prizes, including a $1,000 giveway

- Access to exclusive FinPath partners

- … and more

Employers expect a turnkey experience. We deliver.

256 bit encryption

All private information — including name, e-mail, address, and uploaded documents — is encrypted using AES 256.

Universal eligibility file

Sending eligibility files shouldn’t cause you a headache. We make it easy and effortless to send participant eligibility information.

Impact reports

Tracking success is easy. We provide workforce snapshots so you can see program utilization. Data always remains private.

Communication and Marketing

We’ll provide digital and print marketing material to share with your staff. Emails, flyers, posters, social media graphics… you name it. We got it.

Onsite & Virtual Event Planning

FinPath takes events to the next level. We’ll coordinate with you to setup workshops for your staff. You choose if you prefer in person or online, or a both.

So much more

Really. There’s a ton more to explore in FinPath. We look forward to showing you all we have to offer.

Bring financial education to your employees.