Harmony Public Schools

Retirement Planning Center

This page was created to help you understand key elements of the retirement saving plans available to you through Harmony Public Schools. Having a clear understanding of your pension plan, and retirement saving plans can help lead a successful journey towards financial independence.

Start here for an overview of your retirement benefits:

Retirement Plans ▼

As you get started, please download a copy of the Harmony Public Schools 2022 Retirement Savings Guide containing detailed information about each plan.

The following plans are available to employees of Harmony Public Schools:

The following plans are available to employees of Harmony Public Schools:

- 457(b) Retirement Plan – This is a voluntary plan designed to build savings for your retirement years. This plan is overseen by a board of school superintendents and chief financial officers to help ensure it works in the best interest of educators. Plan highlights include low fees, no commissions, professionally managed investment options, and access to FinPath (financial workshops and coaches).

- 403(b) Savings Plan – This plan offers the flexibility to save for retirement by choosing your preferred investment provider. You may compare 50+ investment companies and decide which one best fits your goals. Note that early withdrawals from a 403(b) account are subject to a 10% tax.

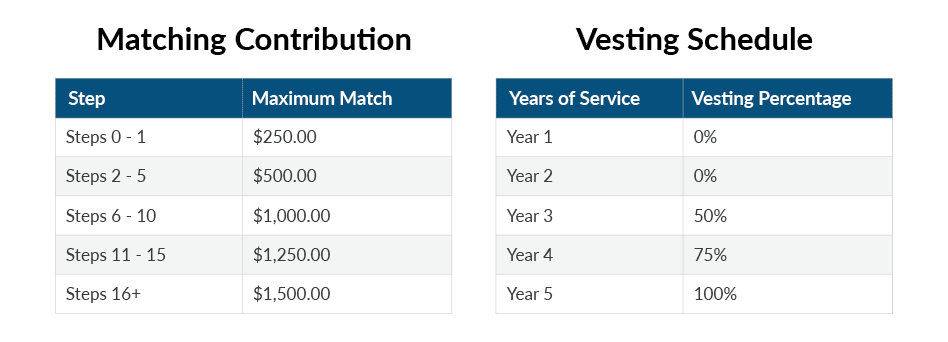

- 401(a) Incentive/Match Plan – Harmony Public Schools now provides an extra incentive to save for retirement and continue employment with the district. The longer you work for the district, the higher your incentive match will be. This plan is automatically created for individuals who participate in the 457(b) or 403(b) plans. Vesting and matching caps apply.

- FICA Alternative Plan – This plan is for seasonal, part-time, and temporary employees of Harmony Public Schools. Rather than contributing to Social Security, this plan contributes directly to a retirement account. Participation is required. Enrollment is automatic.

Meet with a Retirement Plan Specialist ▼

Have questions?

Enrollment assistance is available! Schedule a TeleWealth virtual appointment for help via phone, video chat, or email.

Necesita ayuda?

TCG tiene representantes que le pueden ayudar a responder sus preguntas.

Quick Links

Frequently Asked Questions

What is RAMS?

The Region 10 Education Service Center has partnered with TCG to establish a cooperative called the Retirement Asset Management Services (RAMS) program that provides participating school districts services related to the management of supplemental retirement savings plans. Region 10 partners with school superintendents and chief financial officers to ensure the RAMS program is looking in the best interest of educators/staff.

Who is TCG?

TCG is an investment advisor and retirement plan administrator based in Austin, Texas. Your employer has chosen TCG as the primary group retirement plan partner for your organization. TCG will help manage any questions pertaining to your 457(b) retirement account and can help process limited transactions for your 403(b) account.

How do I register for 457(b) plan?

Enrolling in a 457(b) is easy and only takes a few minutes.

Here are some key benefits of the 457(b) Plan:

Here are some key benefits of the 457(b) Plan:

- Overseen by a committee of school superintendents and chief financial officers

- Fiduciary oversight by TCG Advisors

- Low and transparent fees

- No 10% early distribution penalty tax

- No surrender charges or hidden fees

- No product commissions

- Start/stop contributions at any time

- Professionally-managed portfolios

How to Enroll:

- Click below to get started! The process is easy and will only take you a few minutes!

How do I register for 403(b) plan?

Another option you may consider when planning for retirement is a 403(b) Savings Plan.

Enrollment for this plan is a two-step process. First, you must first establish a 403(b) account with an investment provider from a list of 50+ approved vendors. Second, you will create an account with TCG Administrators to elect your contributions on a pretax or Roth basis and define your beneficiaries.

Enrollment for this plan is a two-step process. First, you must first establish a 403(b) account with an investment provider from a list of 50+ approved vendors. Second, you will create an account with TCG Administrators to elect your contributions on a pretax or Roth basis and define your beneficiaries.

How to enroll:

- Click here to see a list of approved vendors

- Evaluate and contact a vendor on the list and contact them directly to establish your retirement account

- After creating your account with a vendor, click Enroll to setup your online TCG account where you can elect and modify your contributions

- Follow each step until you get a confirmation notice… & you’re done!

How do I register for a 401(a) Incentive/Match Plan?

Enrollment for your 401(a) Incentive/Match Plan is automatic if you are contributing to a 403(b) or a 457(b) account.

Please refer to the 401(a) Summary Plan Description for more information about the plan.

Please refer to the 401(a) Summary Plan Description for more information about the plan.

How do I register for a FICA Alternative Plan?

Participation in the FICA Alternative Plan is required for part-time, seasonal, or temporary staff.

To access your account, follow these instructions:

1. Click the Login button in the upper right-handcorner

2. Click the Group Retirement Plans box

3. User Name will be your Social Security Number (no spaces or dashes): ######### 4. Password will be your date of birth (MMDDYYYY):#########

To access your account, follow these instructions:

1. Click the Login button in the upper right-handcorner

2. Click the Group Retirement Plans box

3. User Name will be your Social Security Number (no spaces or dashes): ######### 4. Password will be your date of birth (MMDDYYYY):#########

How do I request a distribution or a loan?

Visit this link for a list of all available plan forms and requirements. Please fill in the required information and send via fax to 888-989-9247 or by email to info@tcgservices.com.

What are the eligibility requirements?

Eligibility for plans depend on your status as an employee. Please consult with your Human Resources department for specific requirements and eligibility questions.

Should I consolidate old accounts from former employers?

You have a few options to consider when it comes time to leave your employer. It all depends on where you are in your financial journey.

Option 1: Leave money in previous employer’s plan (if permitted)

Option 2: Rollover your money to your new employer’s plan

Option 3: Rollover your money into an IRA

Schedule a meeting with a Retirement Plan Specialist to help you decide your best option.

Option 1: Leave money in previous employer’s plan (if permitted)

Option 2: Rollover your money to your new employer’s plan

Option 3: Rollover your money into an IRA

Schedule a meeting with a Retirement Plan Specialist to help you decide your best option.

Calculators

Investments

Contact Us

800-943-9179

Live assistance when you need it.

Business hours:

Monday through Friday, 8AM – 7PM CST

Find Plan Information & Forms

Looking for a specific document or form from your existing employer plan? Finding it is super easy. Visit our Plan Information portal and search using your employer’s name.

Track Distribution

Have you submitted a loan or distribution request? You can check the status online by checking our Distribution Tracker.

Note: Please allow up to five days from your submission date to check the status.

Submit your Form

Ready to submit your paperwork? Submit a form.